GOL has great strength today.

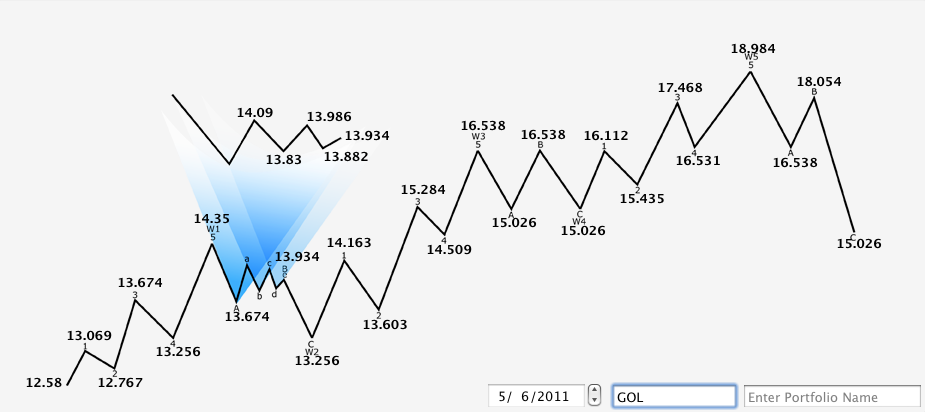

There are two scenario now with todays strength to look for from a technical basis.

First, this current strength is the anticipated beginning of wave 3 of the trend. A very powerful move. This would be wave 1 of parent 3. Target 16.53.

There is nothing much to say about this scenario. I believe that GOL will trade higher long term, right now its a matter of limiting my risk of entry point near term.

Second, the prior chart mark up below gets rehashed a bit to accommodate concerns of entry point that are not yet quelled even in the current market exuberance.

The skepticism for another low to take place is based on the MACD reading and the prior analysis that this is supposed to be a wave 2 correction.

In the chart above we assumed that the B wave was complete and a wave C 5 wave count was begun. The MACD of the wave 3 of this count matched nicely to the count shown above.

Todays price action suggests the trend has changed and wave 1 of parent 3 has begun because wave 2 of C high around 14.17 was exceeded. However, because the correction exceeded .382% this move may suggest the formation of a triangle.

But because we have not met the projected lows yet, and we still believe that this is a wave 2 correction, it is important to realize that the triangle formation would not typically occur in wave 2 unless within the B wave of a traditional ABC correction.

Further triangles formed in the typical wave 3 correction would have a MACD low that represented the largest momentum at the lowest price.

We can see from the prior chart that the MACD made its largest move prior to what would be labeled the A wave of a triangle formation and actually diverged from this low.

At this time, this could be more suggestive of an A wave low of an ABC correction.

Also, the B wave of this new formation below is represented by a peak in MACD at smaller time frames. A wave 1 at smaller time frames would show divergence as it is part of a 5 wave sequence.

Ultimately I think GOL will trade higher, so I could be talking myself out of missing an entry point, but I’m going to wait for a retest of the lower triangle support around 13.68, or most likely the resolution of this triangle formation before entering.

The possible triangle formation concept relative to price motion projections is below, it also shows the internal wave 1 of parent 3 that is in question if the correction is complete.

Pingback: StockSignalTrader: Elliott Wave and MACD Technical Analysis For Traders » GOL Duration Period Update()

Pingback: StockSignalTrader: Elliott Wave and MACD Technical Analysis For Traders » GOL Reaches Price Target()