In the previous post we outlined the price history of the GOLD chart (Rangold Resources). Visit that post for the larger picture and possibilities.

This is a recap of the present price motion and expectations. No position in GOLD.

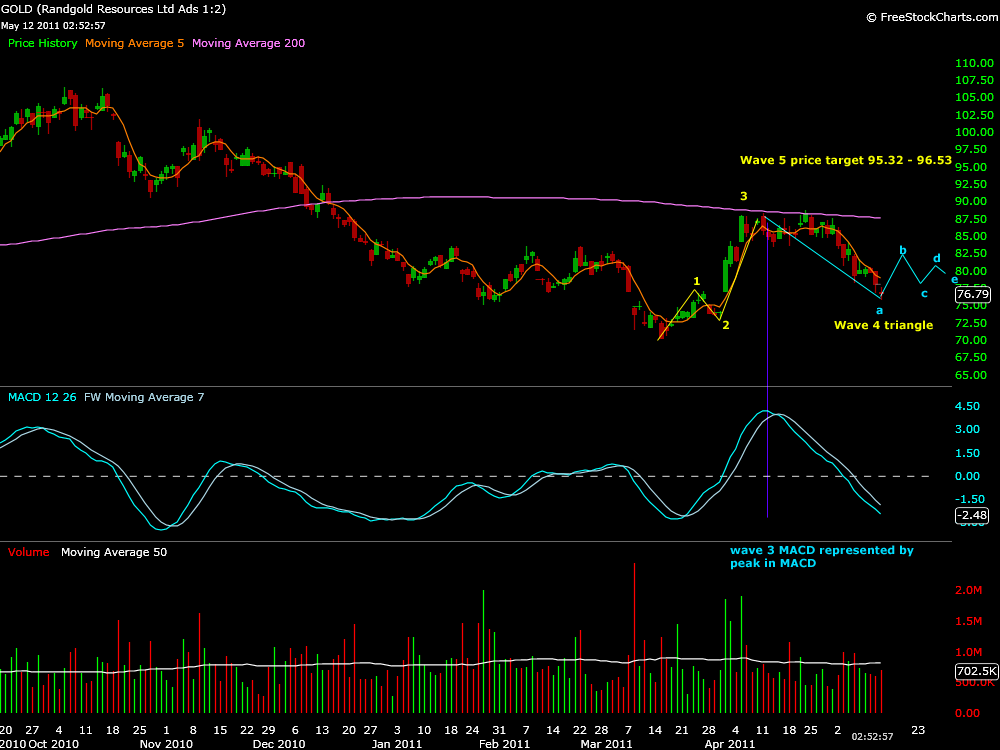

A triangle correction was expected within the larger time frames analysis.

The prior flat or flagging consolidation on the daily chart 4/5/11 – 4/27/11 was expected to break to the 96$ B wave price target.

This anticipated move is shown in the chart below from the previous post.

GOLD did not break higher and has since pulled back. However, what has formed to this point is a fairly obvious 5 wave pattern which still projects the B waves target.

The chart below shows the B waves price motion and now incorporates a wave 4 triangle correction within the 5 waves of B.

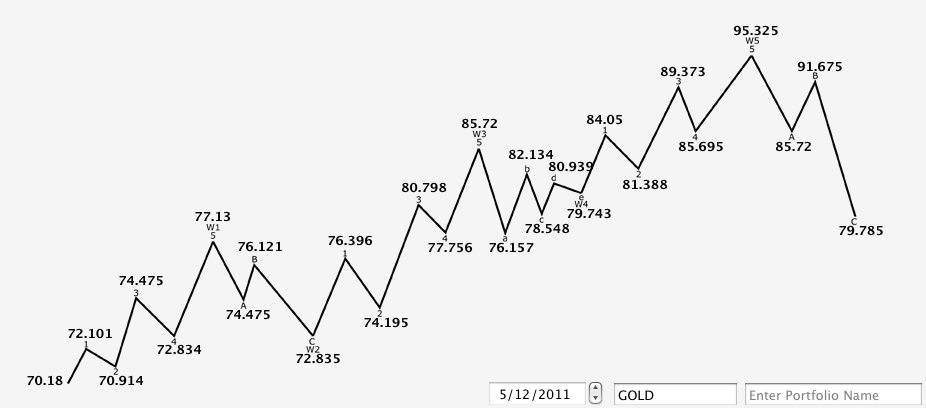

If we use the 70.18 low and the actual wave 1 high to create a calculations chart, the below chart shows possible price motion targets to the wave 5 B wave target incorporating this internal triangle wave 4.

These projections would be negated with trading below the wave 2 projection.