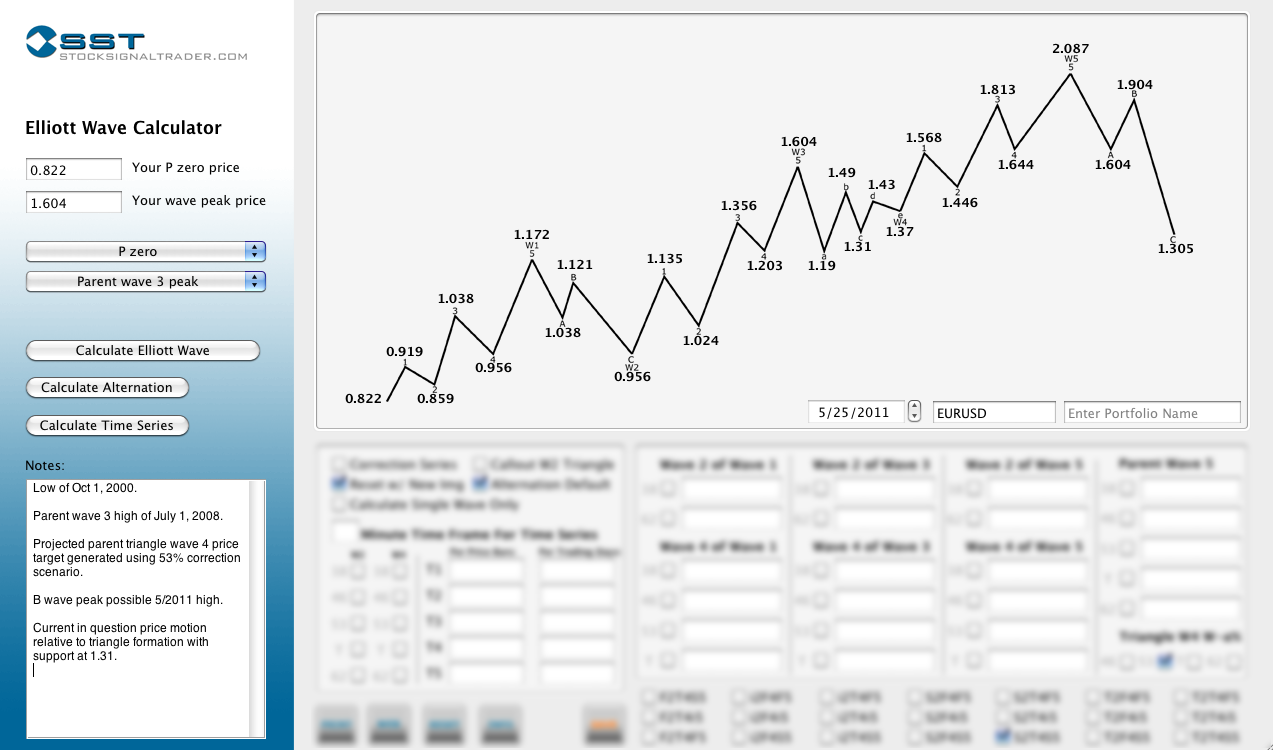

So far the EURUSD Elliott Wave analysis done in late May provided a fairly accurate road map for price action.

In mid July we noted that the 1.3838 level may be significant within the shorter term time frames move as the EURUSD was showing initial support at this level.

Breaking this low was noted possible and the 1.31 monthly time frame level could then be anticipated.

Price in the EURUSD reached 1.31 quite accurately (1.3147) and rebounded to a high of 1.4246. The monthly triangle target price for the D was 1.43.

It is important to remember that according to this particular EURUSD Elliott Wave count price is NOT trending currently. And a triangles price motion is very volatile and capable of testing or creating new marginal lows and highs within its points.

Many times a charts picture does not become worth a thousand words. Even though these projections could have been worth much more if acted on, I don’t anticipate this continuing to be the case.

In my opinion the triangle could be the most deceptive of “morphing” chart patterns.

1.37 is the E wave of the triangles target price. This is where we find the EURUSD this morning and likely where resolution to the Euro crisis continues to surface or dissolve. The chart will morph or build between this point and its C wave low of 1.31 according to the projections.

As a final note Elliott Waves work until they don’t work, not dissimilar to the execution of much simpler trading strategies, however they are more accurate when trend has been established and not in a corrective phase as believed here.

For example, if we are correcting from a parent wave 3 this waves structure was dependent on a test of wave 1 internal or a successful wave 2 internal low. In this sense any corrective parent wave 4 (triangle or simple) that holds wave 2 internal of parent 3 would not negate the uptrend picture even though it falls outside of the anticipated corrective patterns.

The triangle is a projected corrective chart formation not rigidly inclusive of calculating wave count. All trending wave structure is based off wave 1 relative to time frame.

Reference this prior post for documentation of the Elliott Wave charted in May for EURUSD.

As usual time will tell if these formations continue to hold up. I have no position in the EURUSD today.