My prior “trade” in ERY lasted 4 months. It was a mistake that I got out with a profit. I was not in control of my risk. In reality I did not learn anything by holding this long with a loss.

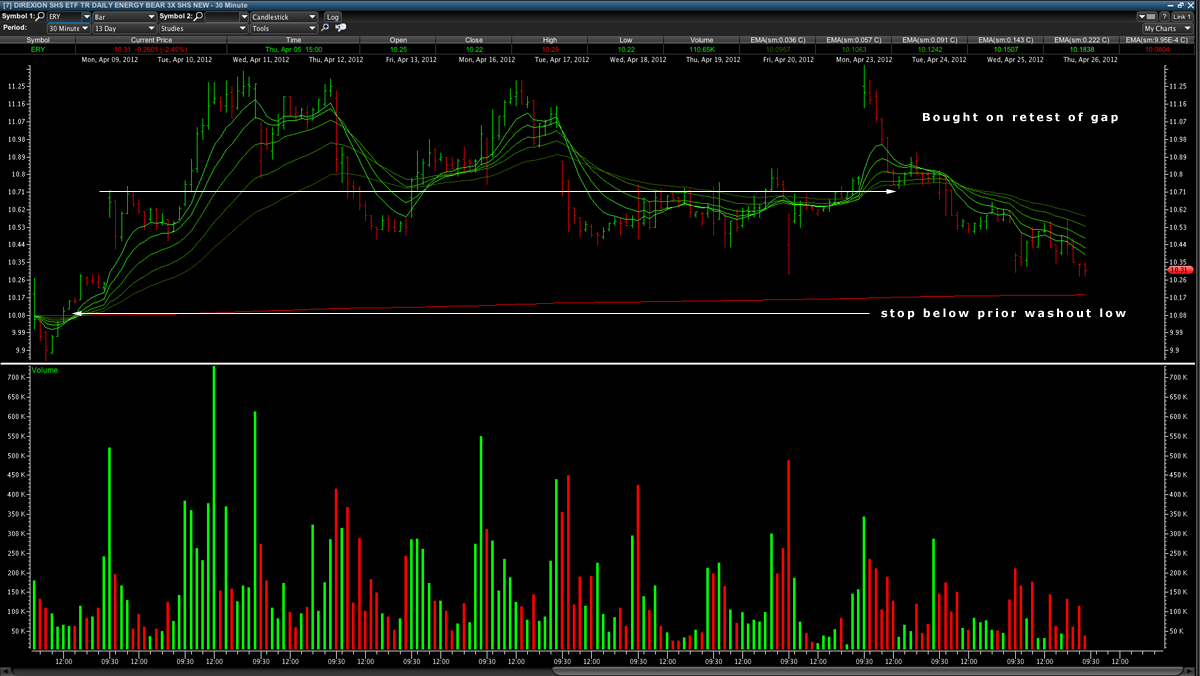

I bought ERY again at 10.76 on Monday 4/23/12. My timing was perhaps too aggressive ahead of a Fed day and oil inventories and a possible reversal candle in the XLE.

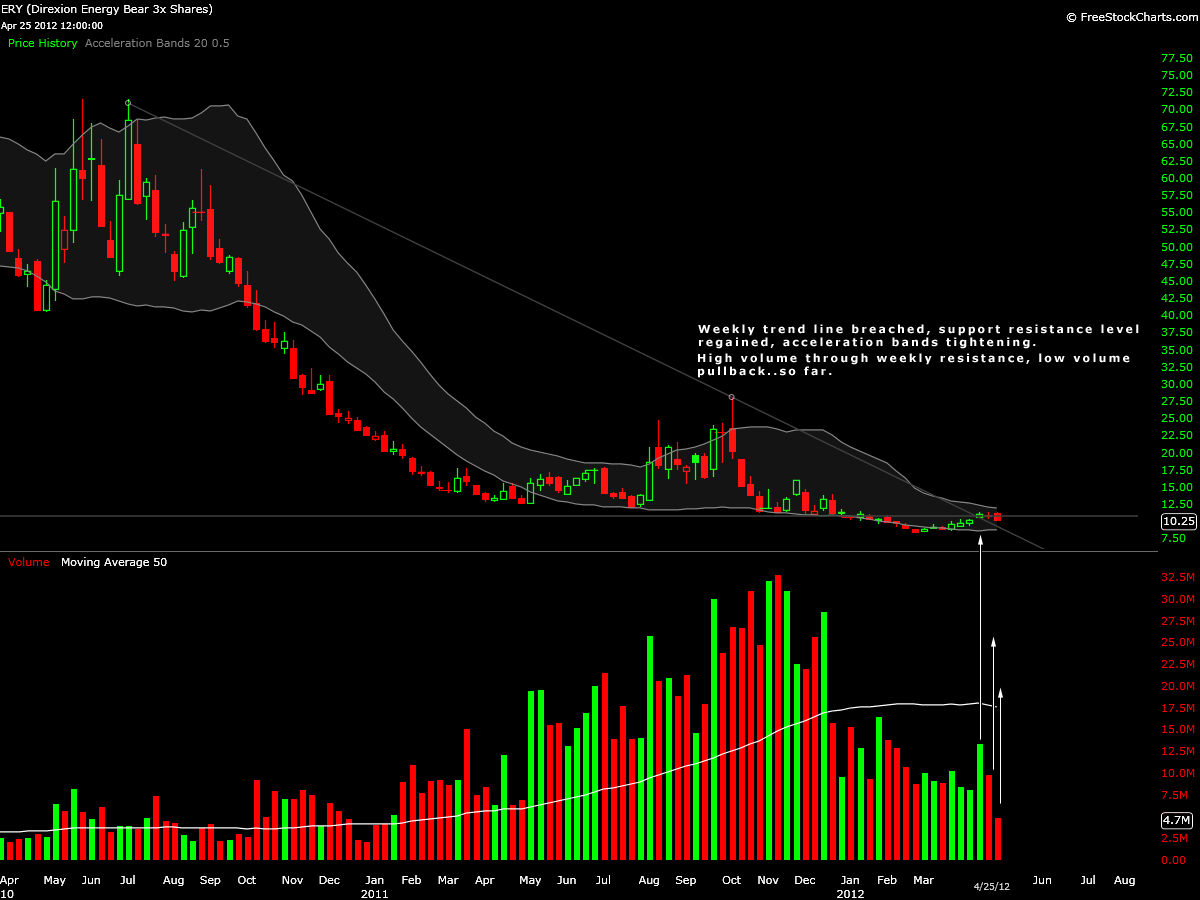

I bought ERY with the same intentions as the prior trade, that the weekly support level would hold, but with a much more loose grip on my ego. Weekly support was 10.73. The highs were around 11.30, they were breached on Monday on a gap higher. I bought the gap fill just above support/prior resistance. The weekly chart also shows that trend line resistance was breached and that acceleration bands were tightening.

This was not a revenge trade, and as I write this it doesn’t appear that the trade will be a winner. I have a stop loss in below the prior Fridays low. Fed day (4/25) was painful but the obvious stops were not where I had mine placed.

The trade was taken on Monday after the gap fill, the charts are marked up and reflect Wednesdays price action and the notes above.

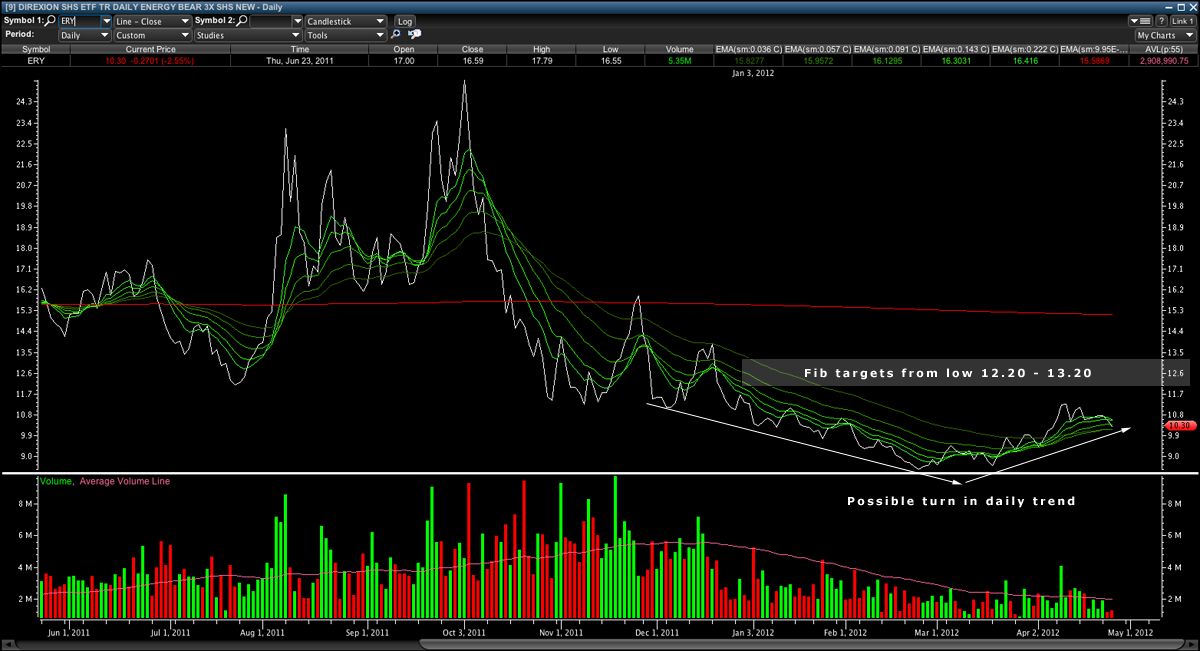

The daily chart on Monday looked as if the support found on the 30 min may hold if the trend was indeed going to continue in an aggressive way and new highs would be made. Overall markets were under pressure and in a risk off environment.

However two things should have pointed to the possibility of a near term retracement from my point of entry that I did not weigh greatly; the daily reversal although not closing in the green had rejected new lows and second the Fibonacci EMAs had not been aggressively tested since a lower high was made on 4/16. I felt the direction of the EMAs since March and weekly price point of 10.73 would trump this and was worth the risk.