Monday the ES_F rallied from overnight lows of 1342.50 to 1375.25 in late afternoon, successfully filling the gap from Fridays close at 13.62.50.

The price action reminded me of the ISM release day when buyers were keeping the price action tight and vertical. The 1min charts from this prior post explain how remaining patient under such circumstances lead to an easily revealed turn (hindsight).

I looked for the same characteristics to show themselves Monday, and I tweeted as such.

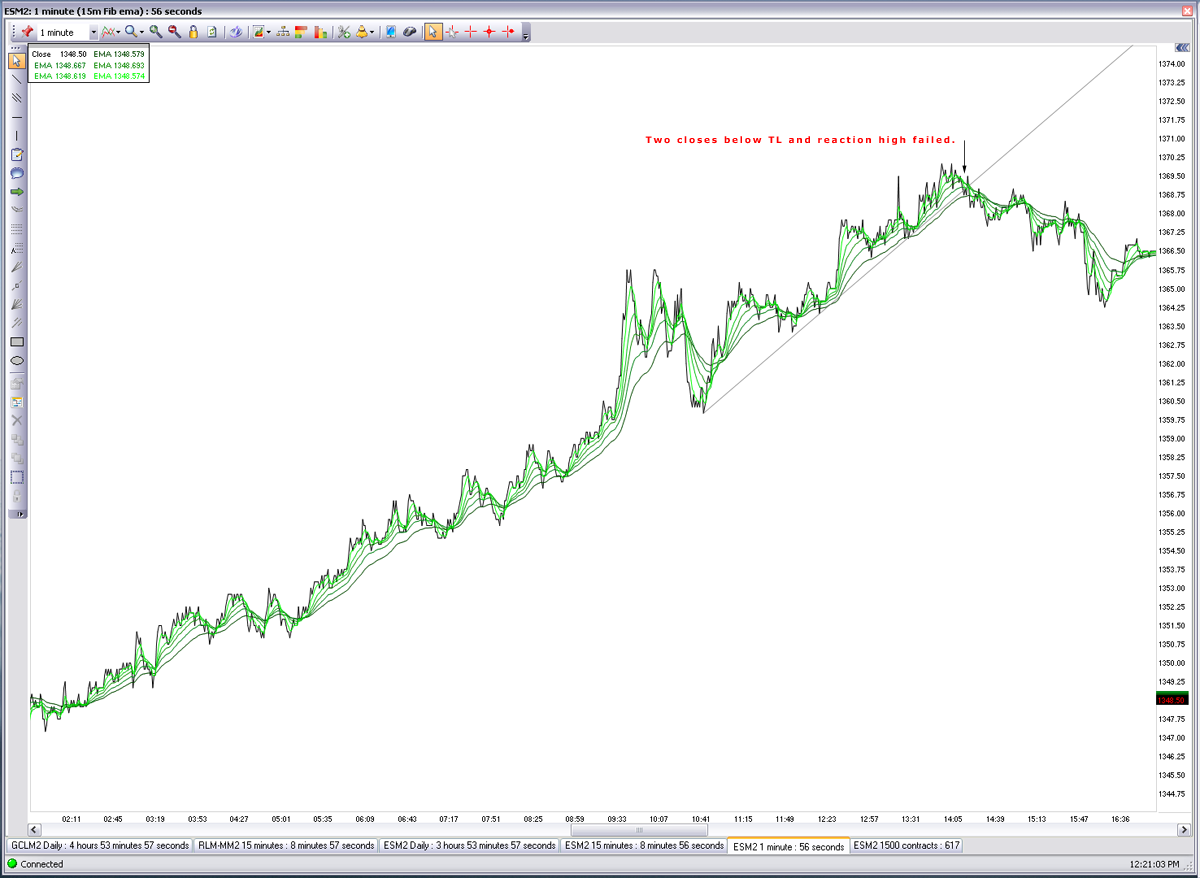

Most of the afternoon was spent watching the 1min and like the prior ISM day price action it was one vertical trend line followed by another. Fib targets were reacting well, but runners were not letting loose. This was/is a key characteristic to make note of and many do in the Stocktwits community. Realizing this can stop you from feeling like the market is off the rails relative to your strategy. A successful strategy is not only subject to questions of time frame from the point of view of your trade setups but also what the market dynamics currently dictate.

At roughly 2:15 05/07/12 and 26pts higher from the ON (overnight) lows the most recent vertical trend line of the 1 min showed two closes below trend line with a reaction high that did not close above the prior high. The “angle of the dangle” was changing and a possible short was revealing itself.

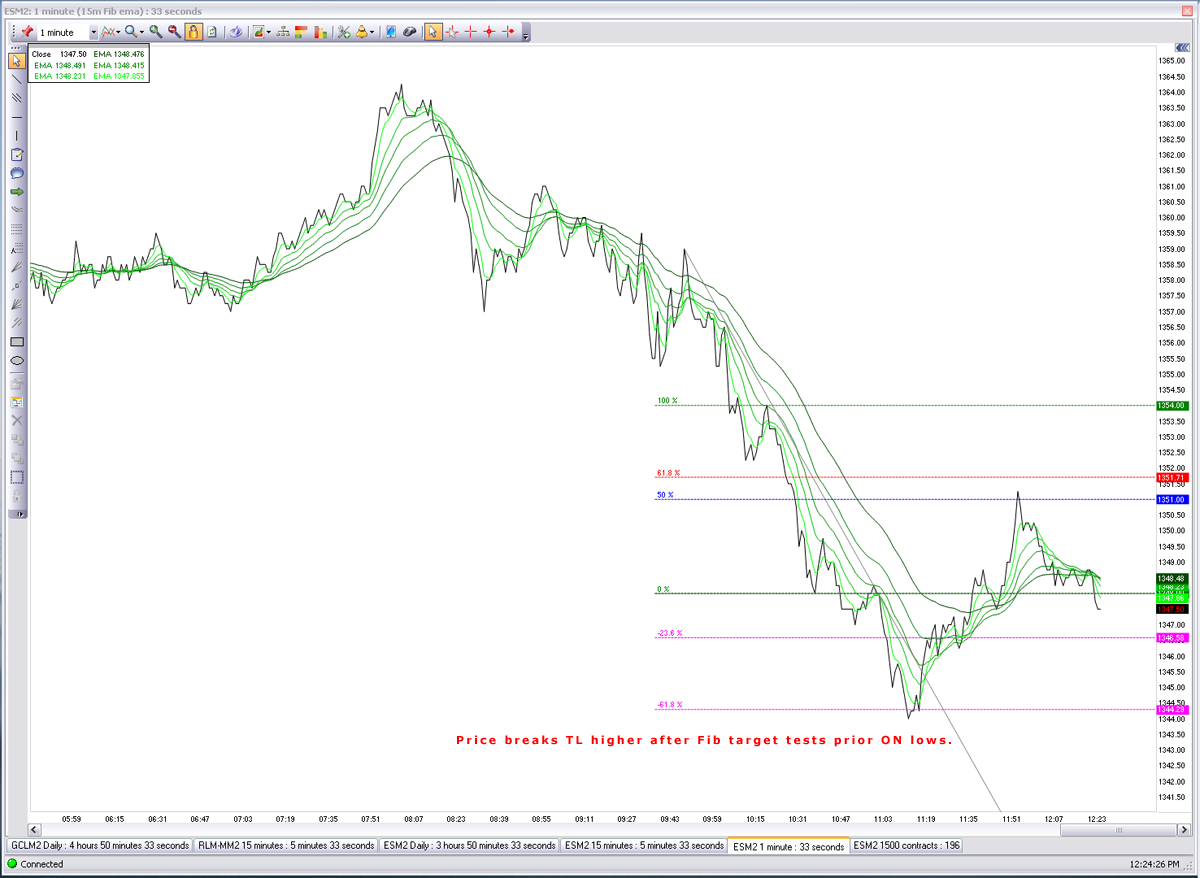

Todays price action was similar again to vertical price action but this time to the downside. With no interest to regain the OR low after a break, we reached for a test of the prior ON lows. This should make sense by now, the OR range has been a great indicator for me.

Today at 11:15 after testing a Fib extention and breaking a vertical trend line on the 1 min, the ES_F seems to be ready to digest. As I write this price action has faded from a 50% level but could be a buying opportunity if the lows will hold.

A test of the ON lows for CL_F as well had me keyed into these possible turning points. I was watching the CL_F closely as I had small undisclosed short position on using the SCO and sold it +9%.

Today, things seemed to make sense to me. That doesn’t mean Ive pinned a turn but I didn’t get hurt. When the market wanted nothing to do with the OR low I was thinking ON lows right away. When we started to make that move in a vertical way I was thinking, next stop risk rewardville and until I saw that I shopped online for cigars.