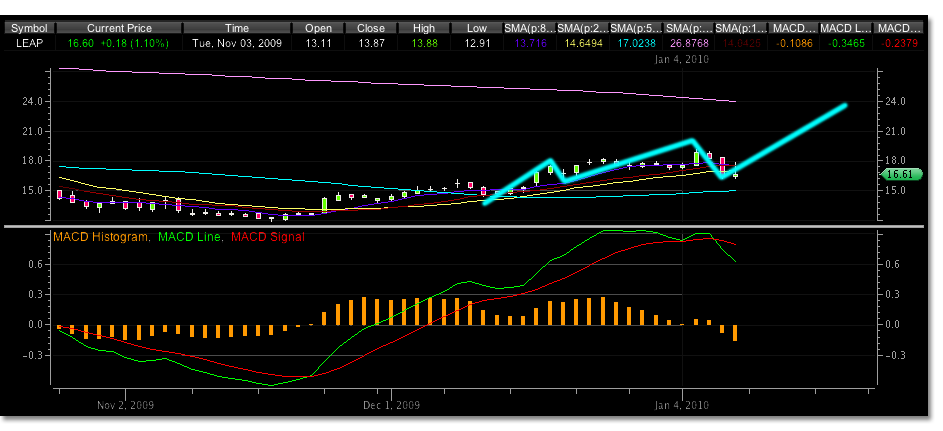

LEAP has been trading nicely within a Elliott Wave pattern. The potential trade setup to watch is the completion of a wave 3 off the 11.98 trading low. This profit level would be about 21.25. There is a trading signal already setup to follow.

The latest trading high for LEAP off the 11.98 low has been 19.21. The underperformance of wave 3 so far leaves room for more upside- if the latest retracement levels hold. The diagram shows three completed waves within the parent wave 3. The following analysis follows the internal waves of the parent wave 3.

LEAP has traded from a high of 19.21, a possible wave 3 high, to a possible wave 4 low of 16.25 yesterday. This is one penny above the wave 2 low of 16.24. If there is still room in the parent wave 3 price target, then this low must hold for LEAP to trade higher.

Today, LEAP tested the internal wave 2 low again trading to 16.27 on very strong volume, but did not rebound nicely as it did this morning off the low.

Reading the MACD on a minute trading time frame, the latest sharp move downward indicates that a third double bottom would have to occur to keep from testing lower support level as a wave 3 MACD may not have been tested sufficiently.

If the parent wave 3 of LEAP is complete, and this internal wave 2 low support level is broken, it is more likely that LEAP will trade towards 14.72 before a move higher. This is a 62% retracement to test the parent wave 2 support level.