This morning EXM traded to a targeted trading level. On a long term chart EXM has traded from 3.00 to 11.70. A 62% Fibonacci retracement of this move would be 6.30. EXM has traded to 6.23 so far today.

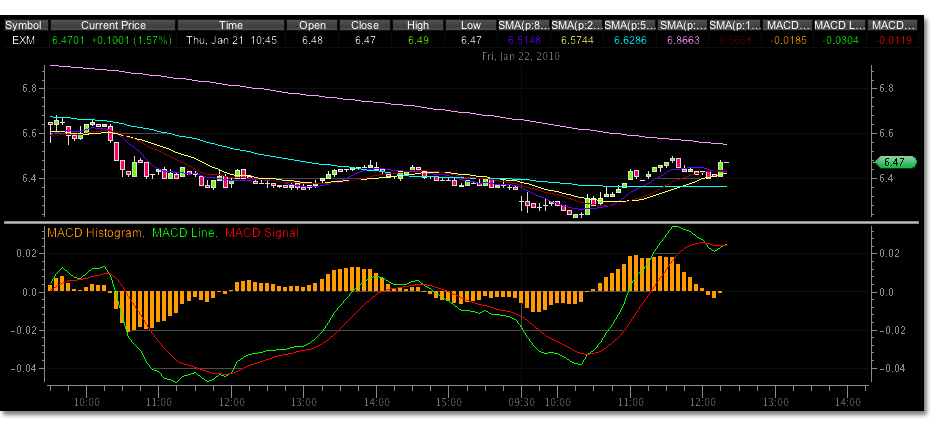

The 5 minute trading time frame chart shows a very nice divergence of the MACD wave 3 and wave 5. With some calculations at smaller time frames, expected trading levels of EXM could still push towards 6.20, 6.15. However, so far this retracement has bounced nicely and could provide the move higher some support.

Further support of previous most recent uptrend from 5.25 to 8.40 appears to be about 5.83, and a possible wave 2 trading low. If EXM holds to the prior trend, it would mean that as EXM approaches its wave 2 low it is nearing completion of the wave 4 correction. A wave 5 price target is near 9.40.