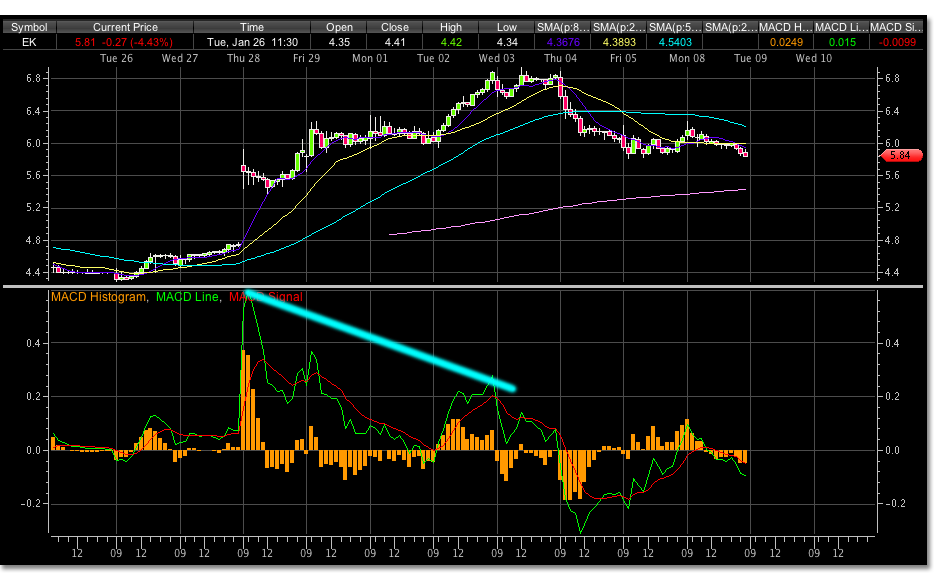

We looked at EK a while back for a turn higher. After slow sideways trading EK’s last move higher created quite a pop and caused some news flow. The latest move started from 3.26 and reached close to the previous high of 6.82 trading to 6.94. This is definitely a wave 5 to some degree in the shorter time frames. Look at a 15 or 30 minute MACD chart for this. In addition, looking at a daily chart this last trading high could be the internal wave 5 of wave 3 of a parent wave 1. Below is a 15 min chart of EK showing a divergence in the possible wave 5 of wave 3 described.

Things to look for in EK would be an simple correction from 6.94 to 5.30 to create an A wave. B wave could be 5.89 and a C wave completing wave 4 of the parent wave 1 could be 4.40. The wave 2 support level appears to be 3.90. A good place to look for buying to return to EK might be between 5.15 and 4.65.

Wave 5 price level could reach 8.10 to 8.20.