Yesterdays trading in MPEL is on course with previously mentioned price targets. With the markets, as well as MPEL, being so extended of late, reevaluating a position to its near and long term targets is a safe thing to do. It is difficult to become overly bearish or overly bullish at any one time no matter how successful your trade has been and not be whipsawed by volatility. Many traders become investors when they loose track of an awareness to trading time frame.

MPEL is up 20% since the 4.76 price level which is a possible prize zero point of parent wave 1 of wave 5. This was speculated to be the launching point for MPEL towards a short term price point of 6.20 and perhaps a long term price point of 7.20. After a large gain of 20% where does MPEL fit into those price targets today?

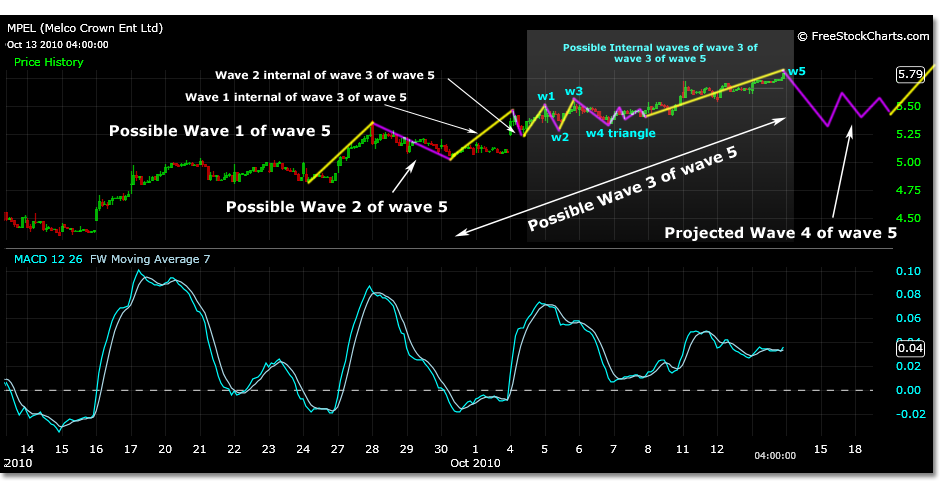

The 6.20 price target is a possible wave 3 of wave 5 price high of the parent wave. If projections are correct, this would be the next price level to take profits at before the final wave begins towards 7.20. The current price motion for MPEL could reveal that MPEL has just completed its wave 3 of wave 3 of wave 5. The chart shows the internal waves of wave 3 of wave 3 of wave 5 with quite accurate projected and actual price points.

Yesterdays price high of 5.79 is more accurate to the following analysis projections than todays brief pop to 5.84. This price point is about 5 cents off an internal wave 3 price target for wave 3 of wave 5. The corrective wave 4 should correct 62% of the move from 5.04. This price level would be around 5.33. The final price zero point for wave 4 should start at 5.49 as it is anticipated to be a triangle correction seen illustrated as projected future price motion in the far right of the chart below.

MPEL has been rallying strong lately. There is a chance that buying pressure will continue to prevail allowing either very little or very volatile pullbacks on the stocks path to higher price points. However, if the following projections hold, MPEL could retrace to the 5.33 level to complete the A wave of a triangle wave 4 before heading higher to 6.20.

The following example of the Elliott Wave price motion model represents the concept of resolution that is possible using this theory. It also exemplifies that the amount of resolution available within one time frame logically varies. Some parent waves are visible within smaller time frames, others are not as well defined. Some internal waves structures are very well defined but easily loose reference to the larger parent waves if time frame is not kept in check.

The chart below highlights the entire sequence of waves illustrated in the top diagram if it were viewed at the resolution of daily time frame.