The following is a short synopsis of the trade I took in TNA. I bought TNA on August 11, 2011 and sold at the end of day.

Entering this trade was based off of four factors.

1. The market was becoming increasingly difficult to pick individual stocks, so the index ETF was watched.

2. I used a new technique, just introduced, called “springs” using a Keltner Channel to analyze volume and price ranges.

3. Larger time frames showed price at and holding a relative extreme to the Keltner Channel range after a prolonged sell off outside of this range.

4. Shorter time frame showed large volume and the successful retest of a “spring” point.

My exit for the trade was targeted quite high. Due to volatility in the markets at the time, I thought this could be a swing.

I had targets of 50 as well as 47.80. These two targets were based off of resistance areas and a gap fill found on 8/811.

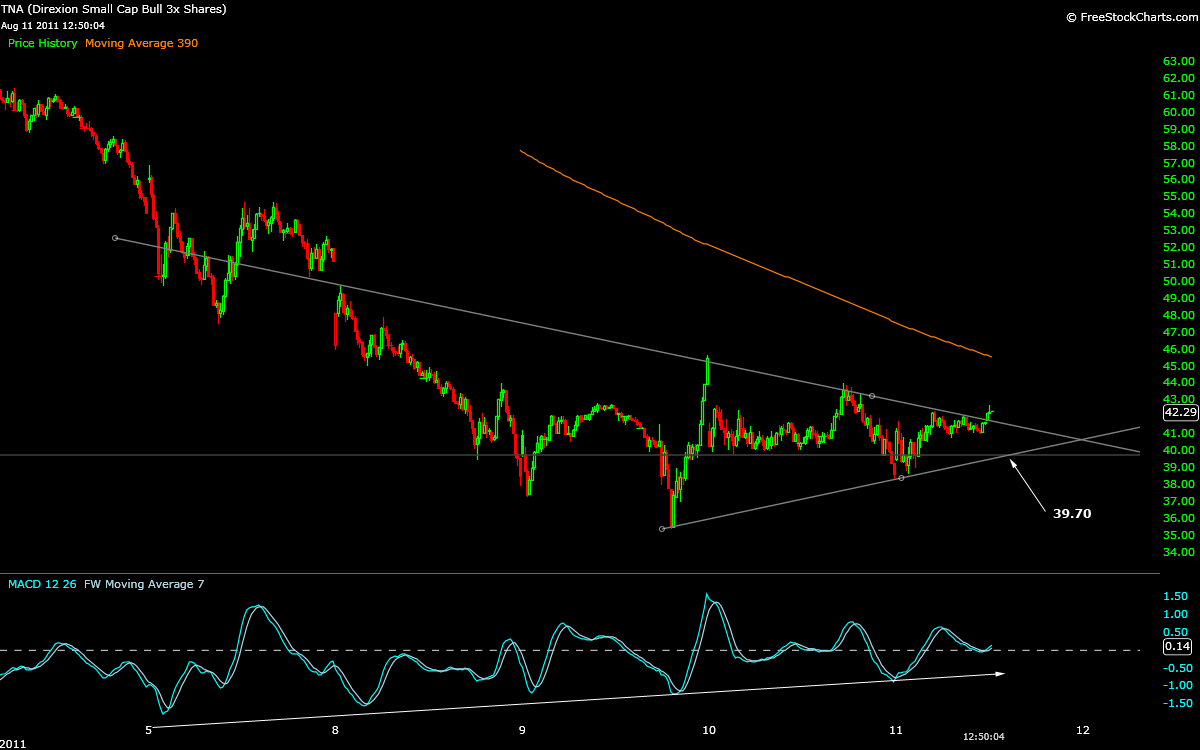

The first chart below shows the hourly time frame for TNA had just re-entered the channel after several days of trading well below its range.

The next chart shows that at the 1min time frame a spring was made on large volume outside of the channel in which the price was relative to testing the hourly lows.

By definition the spring should reach outside of the channel per the time frame you are trading, yet snap readily into the channel on volume.

The successful retest of this low was a potential entry point with a stop below the hourly lows of the prior day, or the spring low depending on risk parameters.

I entered the trade expecting the gap to fill and test the spring low at 38.80. I was filled at this price and allotted myself a 1$ stop.

After this low was made the trade was monitored through support and resistance points, and basic higher highs and higher lows.

TNA acted very well the entire day and made decision making easy. At the end of the day a .50 trailing stop was put in place a few minutes before close and a 17% gain was recorded.

There has been further upside in TNA from the point of sale and price targets were not met on the 11th.

Although using a larger time frame may have kept me in the trade if I held over night, even with the large sell off on the open 8/12/11, with a 17% gain given the markets condition I opted to set my stop tight and call it a day having reached 1$ from initial resistance target.

As well, just after taking a loss in HL, I wanted to be ready for the next trade I saw with “confidence taken back”.

Since making this trade I will note that I have lost feel for what the TNA and the futures market for the S&P are up to as I keep track of them daily. I don’t think I am alone in this regard.

Also, it should be understood that using this method requires proper risk management, and the fact that I was able to pinpoint the bottom in this instance should not be projected with certainty for subsequent bottoms.

TNA rode the outside of the hourly Keltner band for days where the retests failed. Someone sticking to their premonitions off such a strategy could have lost many dollars.

In closing, I have currently come round trip from my initial basis for entering the TNA- individual stocks too hard to pick.

I have started to isolate some potential winners from the current markets indecision’s as trades.

There has been some divergence from the tape in particular names although it is overall a difficult market to time- at least for me.

At this time I have traded in and out of LEAP and SDS and will review those trades as well.