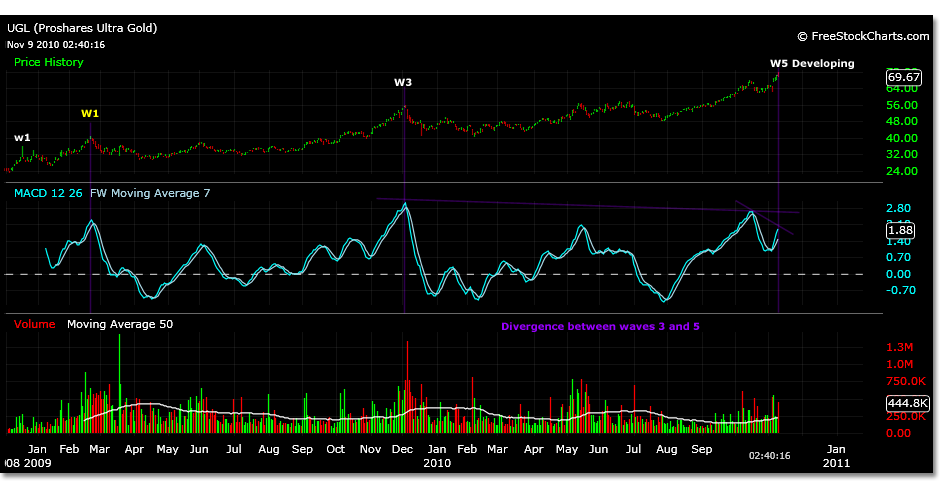

GLL is the ProShares Ultra Short Gold ETF, and it doubled its volume today. UGL, the ProShares Ultra Gold ETF made a 52 week high.

One chart has gone straight up and the other straight down. Simple enough, but a quick look at the technicals inside could show reason for short term reversal.

The GLL chart has been trading up from a 22.86 low and is fairly simple to read, especially tracking Elliott Waves across the MACD indicator.

Wave 3 is the largest MACD reading, wave 1 the peak prior and wave 5 developing now.

Most importantly the MACD shows confirmation of the wave count, by a higher high in price and MACD relative to the wave 1 projection from price zero, as well as, a lower MACD relative to a higher price post the current wave 3 MACD observation.

As trading continues these readings could change, but for now the numbers match fairly accurately for a wave structure that begins at 22.86.

Wave 1 internal actual price high is 36.10. The 40.63 price high that is marked wave 1 in yellow is actually wave 3 internal of the higher time frame showing up on this lower time frames chart due to volatility.

Wave 3 high actual is 55.75 and projected wave 5 high is 70.91. This projection is calculated using the actual 22.80 low and the actual internal wave 1 high of 36.10. Using the higher time frames wave 1 as marked in the chart, projections show room to 76.07.

At the daily time frame resolution, it appears that the GLL may be close to a internal parent wave 3 top. That is to say that these daily time frame projections make up the 5 waves of a internal wave 3 of wave 3 at a larger time frames resolution. The weekly chart shows that a wave 3 is forming with the current trading move and that the 57.75 top is this larger time frames wave 1.

This larger time frames wave 3 target is 96.47. Momentum is definitely to the upside during bullish wave 3. However, if the daily chart will correct there could be volatile trading lower before this target is reached as a daily wave 4 forms.