I have not followed the eur/usd in the past and don’t assume to know any of the correlations. I’ve spent about 3 hours charting and will share a simple minded (2 cents) point of view. Both technically and otherwise I think two things are happening.

First, time stops for no crisis and the Greek/euro crisis can be resolved by time itself. Time is not easily considered as part of a outlined solution but perhaps the only aspect of one that could be working.

To me this is not the same as a lack of solution to the problems. Time can be a solution to many problems and in this broad sense I think that this is what the markets know but the news flows have no idea how to explain as solutions come and go.

During heightened moments of reversion in the eur/usd market relationship, dollar strength will price in the resolution of just how much time is needed.

Second, from a price motion standpoint (which is the only thing I normally focus on) the eur/usd could have much higher prices to reach.

Timing the trend, which I believe could be up, will be difficult at times due to the lack of clarity in both the european and US markets and the noise used to fill the time factor.

I am not convinced today that the dollar is turning lower again just yet, although it has traced the projections nicely and I have already said I think the eur/usd goes higher.

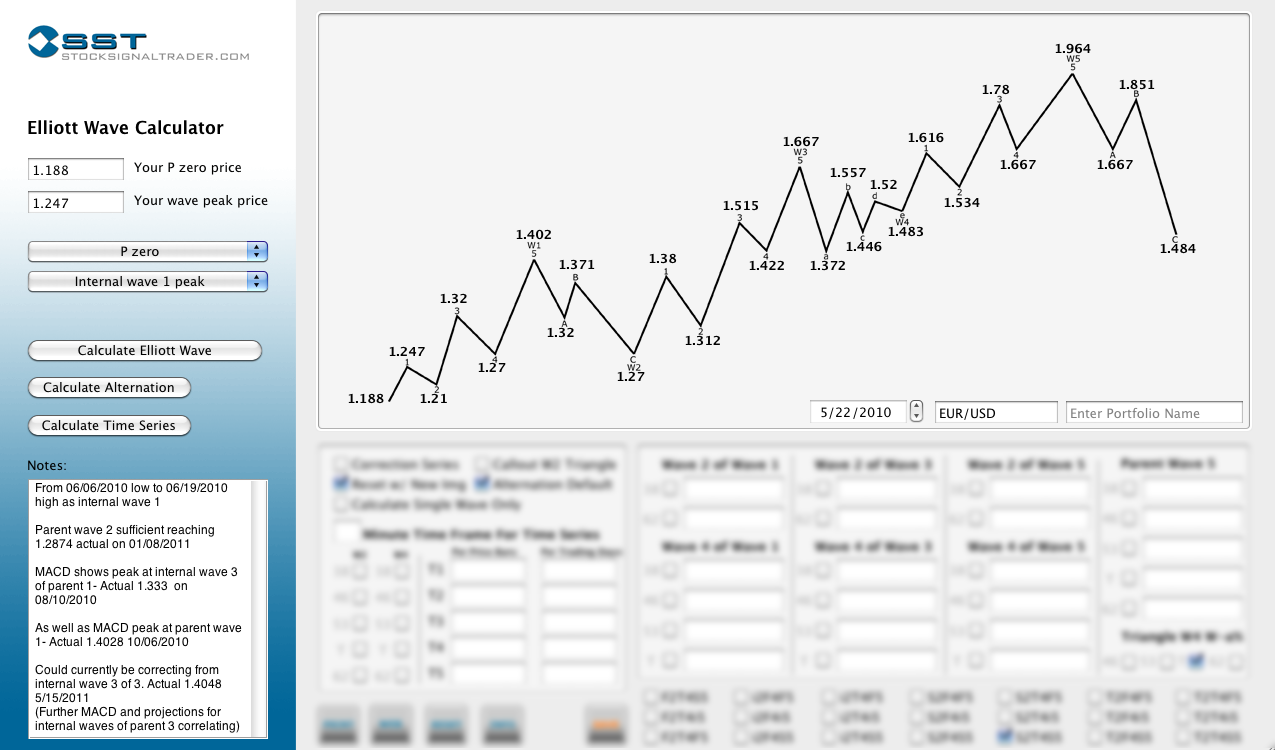

The eur/usd chart shows room to 1.667 from the base used 6/6/2010.

I know this is short term view for such a move but this low does seem significant enough to warrant a 5 wave sequence from its low. Ill call this a daily time frame view.

If eur/usd reaches this high, which would be a parent wave 3, crazy things will likely surface again and time will be priced back into the markets due to further lack of resolution to solutions or perhaps new problems arise as well.

The parent wave 4 pullback should be substantially more significant than the present is the point.

The chart below is generated using Elliott Waves. Currently it appears that we are correcting from internal wave 3 of 3.

The current wave 4, if not complete, could correct up to 1.312 or the equivalent real price point and still be valid.

All the above prices are projected prices based off two real prices- 1.188 to 1.247. The low and high of the internal wave 1 of 1 stated in the chart notes and marked by dates/prices I found using forexpros.com charts.

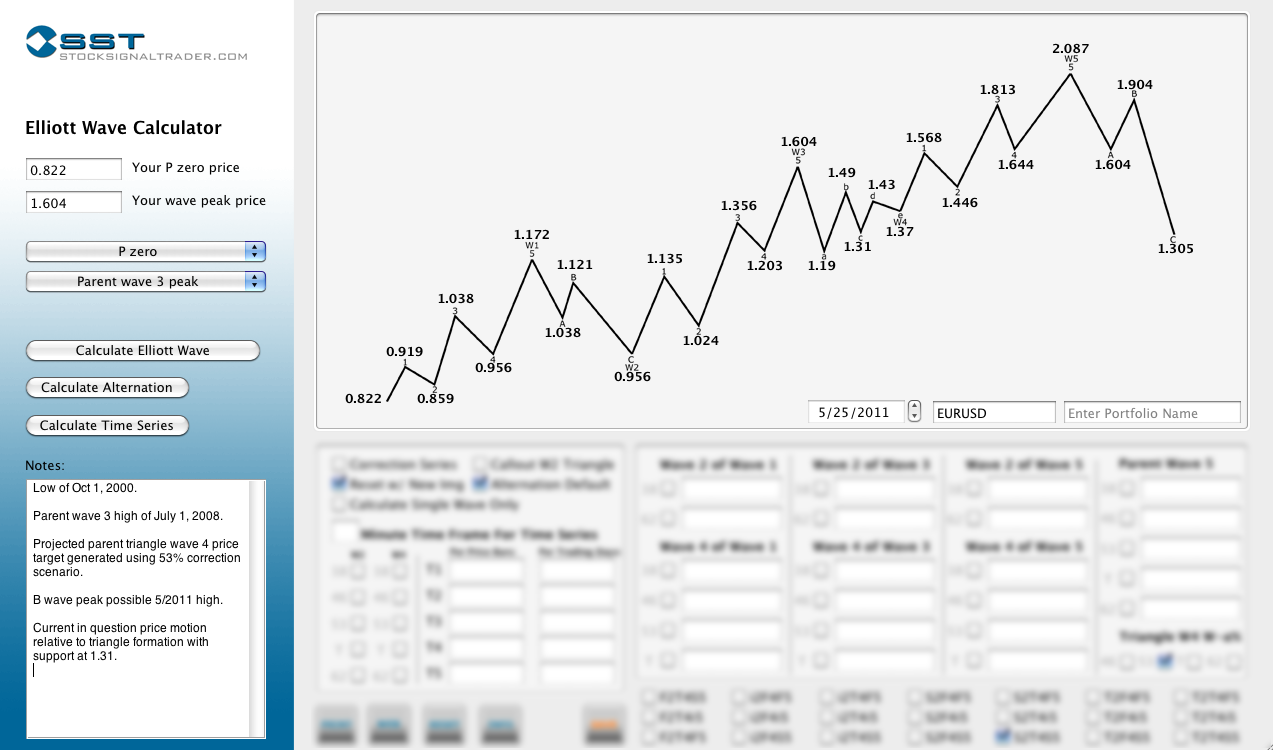

There is further correlation with a larger time frame worth mentioning using a starting point of October 1, 2000 and parent wave 3 of July 1, 2008 shown in the chart below. I’ll call this the monthly time frame view.

This view shows that the above trend, although supportive in theory/projections, could just be noise in the larger trends triangle correction. The triangle formation itself, beyond the count of the B wave, does not necessarily follow an Elliott Wave pattern containing 5 waves.

The monthly view uses two actual price points interpreted as price zero and parent wave 3 of the dates stated and a 53% correction of that magnitude to project future prices and the 1.188 low.

These 5 waves from a much larger sampling correlate to the same end point as the daily view, roughly 2$ as well as pinpoint a B wave peak that correlates to our most recent high on May 1, 2011.

The daily time frame 5 wave projections could complete wave 5 of this parent wave monthly trend as the current price motion seems relative to the triangle formation of this monthly time frames projections.

It is hard to say if the current strength in eur/usd will break out of the triangle formation- reason for the cautionary call for 1.31 to still be in play. But signs of a wave count relative to larger time frame projections based on real prices at significant turning points does seem to be occurring.

I have no current position in the eur/usd.