Melco Crown Entertainment Limited (MPEL), is a developer, owner and, through its subsidiary Melco Crown Gaming, operator of casino gaming and entertainment resort facilities focused on the Macau market.

MPEL is starting to look interesting. MPEL was mentioned on the news monday and popped quite dramatically. Apparently it was not done correcting as it has traded past its trading low before the pop. Today 4.26 showed support although immediately after the bell the stock traded to 4.25 briefly.

From the March low of 2.27, MPEL is over extended in its correction from the high of 8.45. Currently MPEL is trading below its 62% Fibonacci retracement level of 4.61. There has been prior support at 3.95 and todays volume was above average. If MPEL is to trade higher it may make a final push towards the 4.00 mark first.

It’s hard to read on a much longer term chart if MPEL is complete its prior downward move though. A weekly 3 year chart shows a large wave 3 MACD wave. The previous move higher to the 8.45 level, possibly being the wave 4 correction to a 5 wave downtrend since the stocks IPO. A downtrend ends in 5 waves, so this long term chart is incomplete and traders should be aware that a lower low has not been made since the Wave 3 MACD cross.

Contrary to this, the MACD 15 min and 30 min are in the process of completing there wave 5’s. Because MPEL is a relatively new stock IPO December 2006, it is often the case that the pricing of the IPO is incorrect or in correction for some time and a normalized Elliott Wave analysis is not as pertinent until its price history develops enough memory or correlation to the Elliott Wave that it trades within the present.

As this correlation becomes more and more apparent, such as it has been developing since the March low, MPEL is in a wave 4 correction on a daily chart. Often a wave 4 corrects to its wave 2 level which is what is happening right now. The wave 2 low was 4.05. If MPEL is to remain in the uptrend from the March lows it could trade to 14 dollar range completing a wave 5 uptrend.

On the other hand, if the previous daily wave 3 high of 8.45 was the top to corrective wave 4 as the weekly chart shows then MPEL will trade much lower than its March low to finish a 5 wave downtrend.

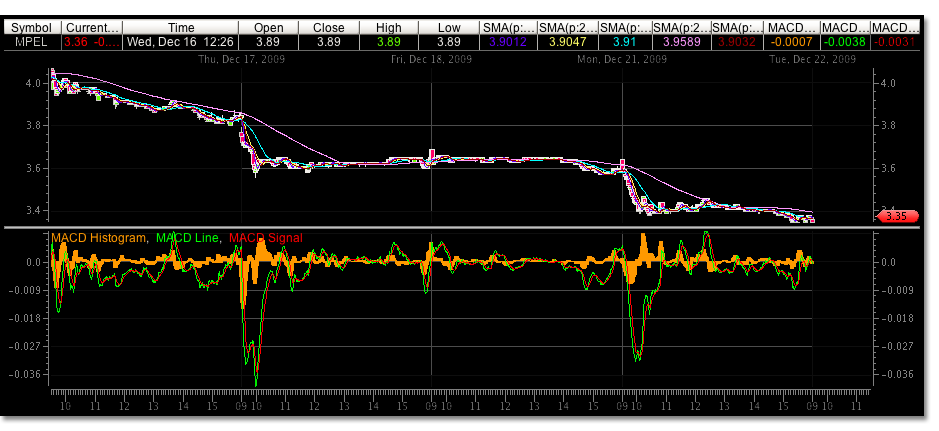

An update to the trading action from MPEL, today is December 21, 2009. MPEL has traded in many small increments along its long downtrend. Has anything changed. We’ve been trying to pinpoint a turning point in MPEL and although we may have been able to trade in and out of the stock, the trading pressure to the downside has been unrelenting to any long term holders.

Pressure in the stock could be coming from the unresolved monthly chart, where there is still potential for a wave 5 to take out the lows of 2.27. The monthly chart for MPEL is fairly “young” it has only traded since November 2006, this may be one reason why would not see a completion in the monthly chart of a wave 5 as we noted earlier in the first diagram. As far as MACD is concerned there is an unresolved wave 3 on the monthly chart which also is warning to lower prices however, it could be possible to not see this wave 5 in the monthly chart form in a usual fashion because of the short period of time the stock has been trading or lack of trading volatility.

Yet, as important and unresolved the monthly chart is, there are some signals easier to read on the subsequent smaller time frames at this moment. Many MACD signals have developed worth watching. As well, there is an interesting duration period coming up that could resolve any downtrend bewilderment. It is dangerous to trade with a long term trading strategy if the largest MACD trading time frame is unresolved. The charts below show the monthly and then weekly MACD.

The largest negative waves in the MACD represent potential wave 3. You can see that at this point there is a lack of information in the monthly chart. There does seem to be enough information to say that MPEL is done with its wave 4 on the weekly chart and forming its final wave 5. Wave 5 should show divergence from the wave 3 on this weekly chart, but create a lower price low. This is important to remember as if this trading scenario plays out MPEL will trade below its 52 week low.

Once a wave 4 is completed in the largest time frame, you can reduce your trading time frame for analysis, or for trading, to dial in the resolution of a stocks price turing point using MACD. If the potential MACD wave 5 goes beyond its wave 3 low, then the wave count was off or needs to reset and the current move that surpasses the prior low is the wave 3.

In the 60 minute trading time frame chart below you can see that the wave 4 MACD is approaching the wave 3 low. This is good if it holds this low and a signal crossing occurs. It would signal a turning point and a resolution of wave 5. This particular time frame for MPEL is perhaps the one to watch closest at this time to understand if MPEL is going to trade much lower. Watch for this wave 5 to resolve itself or a “new” wave 3 to form. If a new wave 3 forms it is more likely that the monthly chart will take out the 52 week low.

In the thirty minute trading time frame chart below, you can see an example of how what was thought to be the largest wave in the MACD and a wave 3 was not. Notice how the second largest wave MACD level was broken, this corresponds to the formation of a new wave 3 and much lower lows in prices. This chart also shows that wave 4 is near completion if a signal crossing occurs and the wave 3 MACD level is not broken.

In the next 3 charts- 15 minute, 5 minute and 3 minute trading time frame MACD in that order- notice that a potential wave 5 is completed as the largest wave MACD in its 5 wave duration period has been tested and created a divergence to lower lows in price.

In the smallest time frame that I can chart, the one minute trading time frame, there still is room for a test of the current wave 3 MACD reading and lower prices after todays trading. Respectively, if any of the larger time frames MACD levels are violated, it is certain that the lower trading time frames MACD levels will be as well. That is why it is important to begin resolving what wave you are analyzing at the largest time frame even if you are not trading that time frame.

In the one minute trading time frame chart shown below, watch for this largest wave to be tested with lower trading prices than todays lows of 3.34. If the MACD level holds begin trading MPEL to the “long” side with this new low as a stop.

Depending on how the analysis and resolution of waves at larger time frames unfold, this price turning point may only be a correction in the larger downtrend. For now, it does appear that a turning point in MPEL to the upside, though at lower prices, could be eminent in the next few trading days if the prior analysis holds true. If you are not aware of the wave count at this time, look for MPEL to correct to its 200 day moving averages if this turning point occurs.

Concerning a possible duration turning point, a turing point based time alone, it is important to notice that the last two monthly turning points were realized in the month of January. This is particularly interesting because we are approaching this time period, as well this trading time periods MACD is unresolved. The preciseness of a duration period turning point should not be underestimated as a key indicator. Take a look at the LEAP Wireless duration period analysis that was charted recently and was spot on again for a huge move if you want to see the consistency it can at times indicate for trading opportunities.