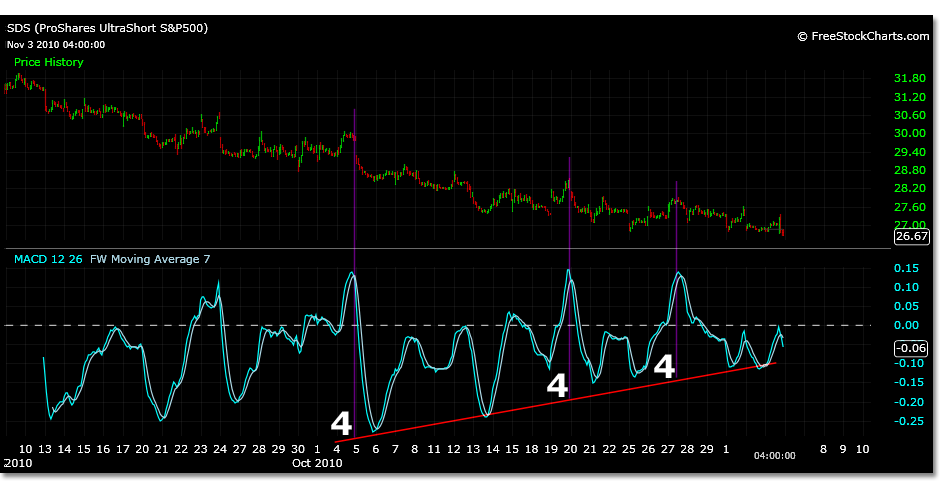

The other day SDS was trading off recent lows with support. Yet, once, twice, three times- a fourth time tested bottom does not make a bottom. In most cases a bottom can only be tested twice successfully. Today SDS broke the low of 27.76 after trading to a high of 27.35 and settled the after hours session at a low of 26.53. This opens up the possibility of reaching the targeted 25.38 and 24.27 trading levels.

The 24.27 low was calculated from a possible wave 4 top to wave 1 low of 30.03 to 28.44 as mentioned in the previous posting. It also negates the wave 1 formation, instead reiterating this MACD wave as another possible wave 4. If the old analysis wave 1 peak is now a wave 4, calculations from this new wave 4 target 24.79 as a possible price reversal point. Close to the other projections at larger time frames.

Also during the frenzy of Fed news, the Dow traded to a within 31 points of its April high, the S&P within 21 points and the Nasdaq broke its April high by just over 6 points.