I had set my expectations high for being in a bottomless market- unrightfully. Nevertheless there was a plan. Although it didn’t follow through, at least I did.

I will say, I should have heeded my earlier premonitions to keep my trading time frame shorter. This trade has come and gone, but I will review my thoughts below.

Thursday, at the end of the day, I tweeted a quick thought of what I had been watching during the session.

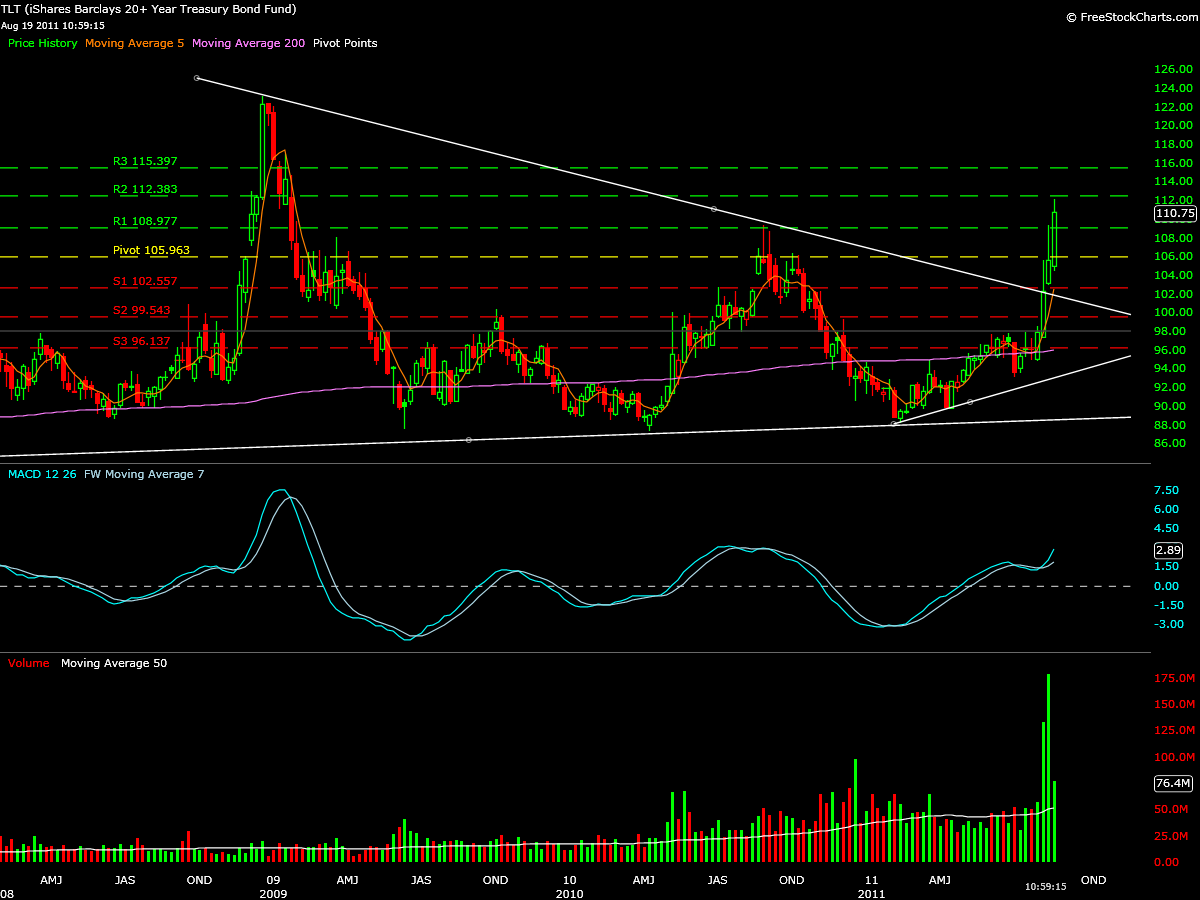

I noticed that the SDS was finding some resistance at a weekly pivot level- for the moment.

I noticed that the TLT had reached a weekly R2 level- for the moment.

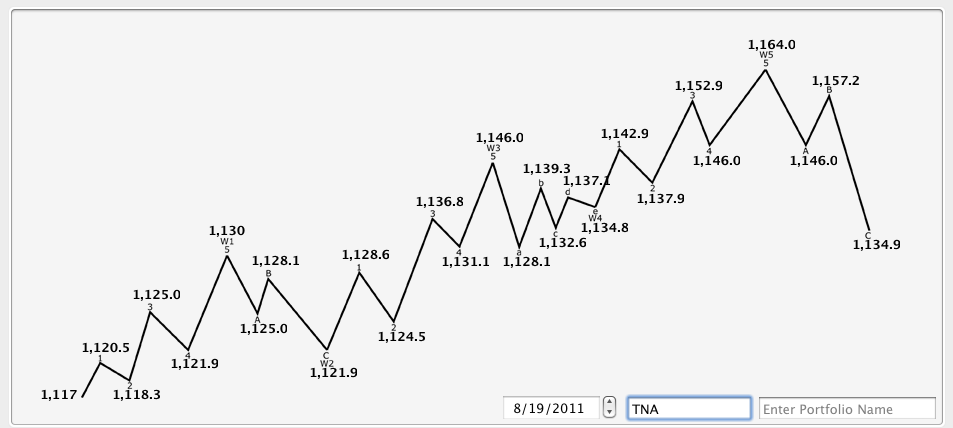

I also had been watching the S&P futures and was anticipating a few things.

First, I had held an SDS position the prior day and got washed out unfortunately. After seeing this was a false move, I still had a target of 1150 for the futures for a sale of that SDS position.

Second, during Thursday’s session, 8/18/11, it became very clear that the futures did not want to trade above the 50% retracement level.

Third, because of these factors I expected the 618 retracement level to be tested and likely breached.

In addition, the TNA weekly chart showed that last weeks close respected the weekly pivot point after it tested R1.

I was interested in placing a trade in the TNA near the bottom of the low in TNA, which at this time is 35.36 for the prior week.

The idea was that the SDS and TLT may be at near term turning points, and the TNA may hold opportunity to the upside off a test of this low.

Further, if the TNA were to test this low and close above or near its pivot point as it had the week prior (too high of an expectation) a “tweezer bottom” pattern would form on the weekly chart.

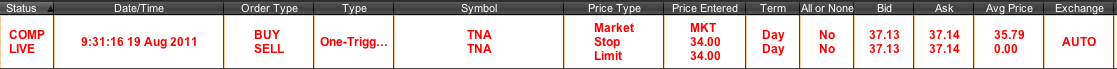

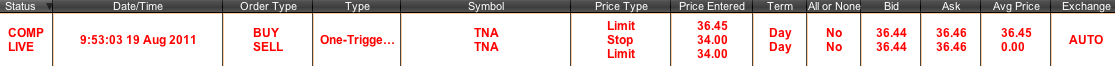

Friday morning the futures were down and I readied myself with an order and a stop loss of 34$.

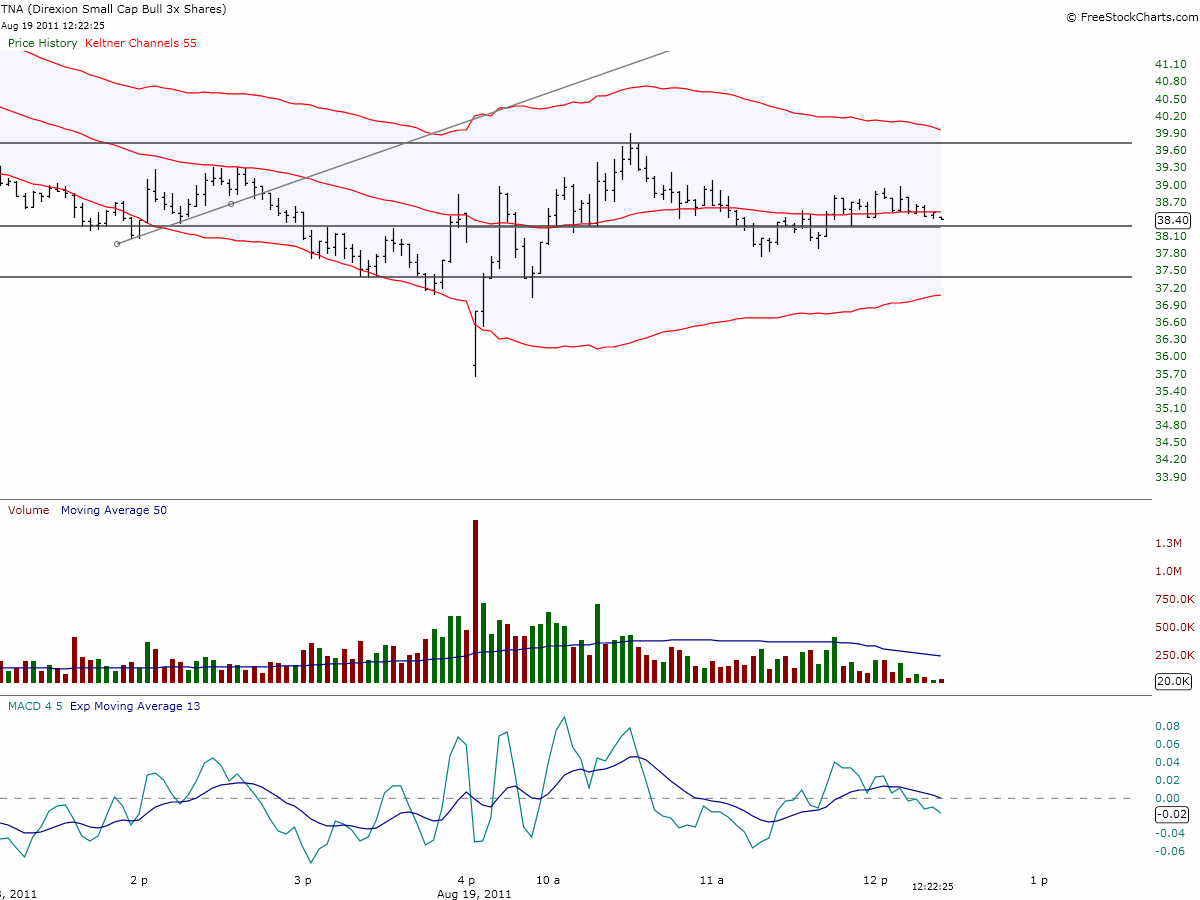

I utilized the prior TNA trade technique of “springs” and monitored the Keltner Chanels for possible extremes on volume.

My initial target was 36.12, but with the gap open much lower I thought it would be better to take half position size with the same stop using a market order since the action would be fast testing the low.

I only wanted to enter the order if I saw over 400k shares trade at the open. This was relative to the prior days open. I saw this volume and entered the order. I got filled at 35.79.

The chart below is a 3min Keltner Channel that shows the spring that I bought on.

Since TNA launched nicely from this low “spring” point, “hope” was in the air (sarcasm) and it was my intention to add to my position if TNA reached 36.45.

This price could represent the test of this spring point. I would hold over the weekend if price action confirmed upside possible. My stop would remain the same.

If TNA did not rally into the close, I did not wish to be flat or under with this position into the weekend, and would sell if my stop didn’t get hit first.

The volatility was nice till this point.

Long into the day and drained of “emotional capital”, my order for 36.45 filled. My basis was now 36.12. The volatility was gone and there was NO bounce in this market.

I waited for a rally into the close possibly to the 1139 level, which would have probably kept me in the trade but nothing such came.

I exited the trade at 36.03 right before the close for marginal losses.

There are some Elliott Wave correlations if this weekly low should hold for a move in the S&P futures to 1164.

Some things that happened in this trade; I timed the entry points well relative to possible support and a possible price reversal points based on the Keltner Chanel. I did nothing to protect my gains because of larger perceived gains and price motion. I executed the trading plan as stated.

In my last post on LEAP I noted how I had lost emotional capital due to timing my trade improperly. In this trade my timing was good in my initial entry, and somewhat good in my second but a bounce did not come. I should have realized that this may have been the case after the volatility left the market after the open.

Emotional capital was still a factor in this trade and I believe I had the wrong time frame in mind for my exit. I could have went with a normal size position on the open with a tighter stop with the anticipation to take half off into a rally and not believe that a swing trade on a friday afternoon was possible in this market.

I certainly didn’t feel that a swing was possible after 11am. I was patient in my trade and executed it not letting emotion dictate, but there was lousy price action after the open and I should have let that alter my swing thesis.

Going forward, I need to let the market prove to me it is worth more than a day trade. Right now I can not anticipate hitting a homer even if my timing plays out in tune.