I traded Sprint and Paetec Corp so far this week and entered a starter position in the SDS.

I did not disclose these positions on the stream, but they were tickers I did call attention to.

I had some internet problems today that kept me offline for half of the session unfortunately.

Below is the chart of Sprint that was posted. I was following horizontal support which turned into a diamond bottom pattern which did not resolve as anticipated intraday 8/26/11.

It did however resolve on Monday with a gap higher. I was in the trade before the gap. My position size was small so I didn’t mind holding over the weekend with a stop below the range low.

The enter and exit orders for gains.

Im still interested in trading S. It could continue higher. The stock seemed to be at resistance of the median line today after a news based run. I decided to take profits.

The PAET trade was initiated just yesterday. I got this stock off a scan and liked its monthly breakout level of 5.30.

I liked how it held this level on 8/29/11 so I entered the trade on 8/30 after the open held the low of 8.38.

I think this could be a huge mover, but I don’t trade breakouts very often and questioned holding longer in this market from this level. My position size may have been to big.

I sold today as the daily chart printed a shooting star above the median line of the pitchfork. Even though this move on the monthly time frame may just be beginning intermediate time frames looked extended.

Daily chart shooting star above pitchfork median line.

30 min chart possible pitchfork resistance.

The gap to breach prior resistance at the median line may make for a run higher, but it didn’t settle well with me in this market.

I would have liked to see the gap fill after the open and a run higher today. Instead it just traded sideways above resistance and printed the shooting star for the day.

The enter and exit orders for gains.

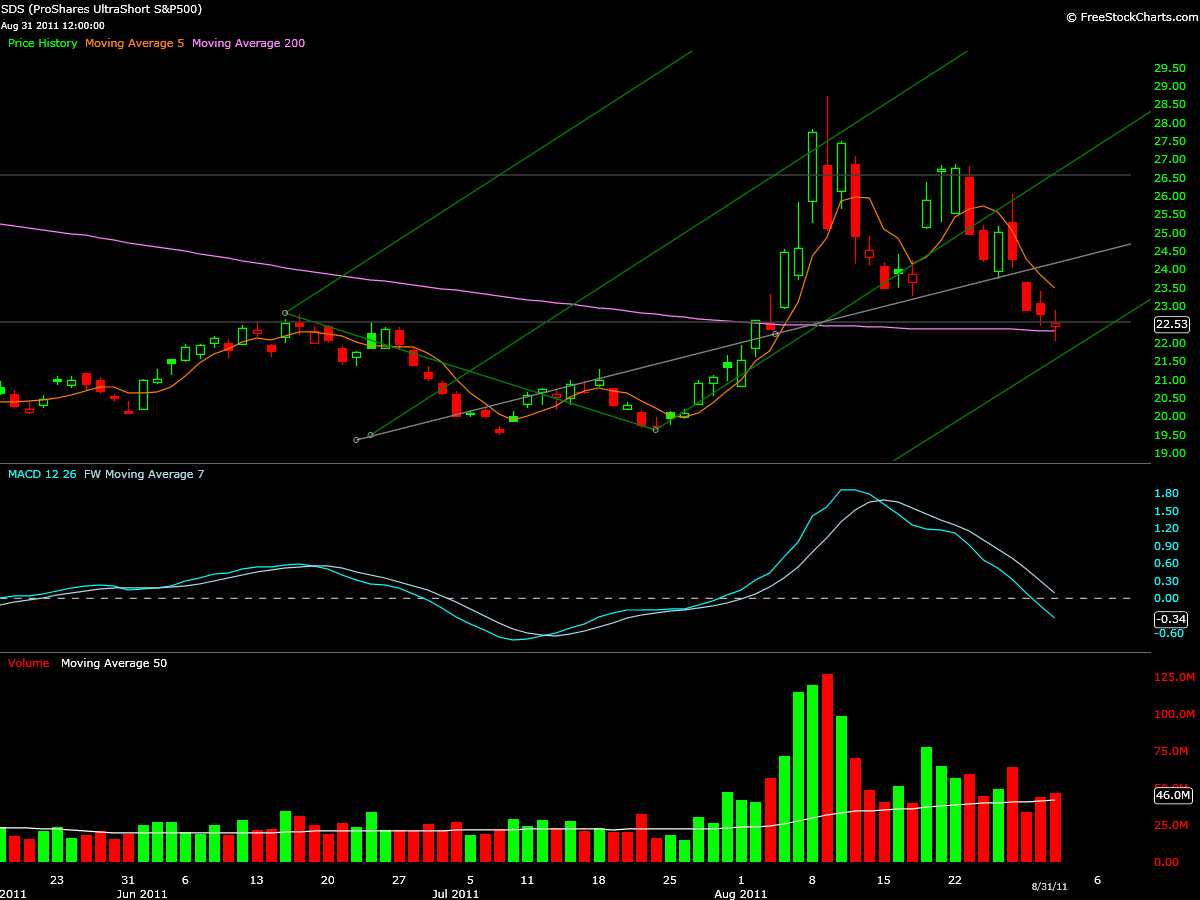

Finally, I’ve been thinking about scaling into the SDS. I have noted on the stream some possible targets for SDS earlier in the week. So far 22.75 has been reached.

Today I initiated a strategy that could create a longer term holding in the SDS- basis around 21.00 depending on volatility. Sell stop will be about 2$. Upside target 35.50.

Right now I own a quarter size position at 22.25.

I’m watching the previously posted pitchforks that are in play with SDS and a possible reaction line that could provide support 21.50 – 21.00.