Inspired by Phil Pearlman’s call to action Im going to try and share my thoughts on the overnight Cyprus event.

First off, Sunday was a day of sluggish thoughts about the week to come as I had a great St Paddy’s day weekend here with friends and family. Watching the market the week prior I thought it was showing signs of struggling with this years relentless move higher. Anyone ever struggled with relentless before? Seems natural, but has that stopped you? I was prepared for continued consolidation, another fearful moment or perhaps some reversion.

When news of Cyprus hit my first thought was…what is Cyprus? Not completely untrue, but whats the point of this. For the past two-three weeks I hear about Europe weakness. Rightfully aware, but is that effecting your positions or your emotions. Ive said this once before and believe it is playing out, “this culture of fear will be tested sorely.”

Our market “rally” is not a rally to break, its a recovery to run or revert. Its about the U.S. and energy evolution- to me. And I don’t care about Europe as much as the price of our stocks and markets don’t care either.There could always be a black swan event, but Im not going to position for it.

I was attentive to the opening gap Sunday evening. I did not feel nervous about my longs, they were few and small I hadn’t let my confidence in recovery mask my sensibility for risk. I was more concerned about my short position, which will remain undisclosed though if you read my stream you’ll know what Im disliking. Will I add to this short, when will I add, is my sentiment too grounded after such a long period of holding, does my recovery picture and position change because of this Cyprus news, should my risk change?

Many questions, but still very little emotion to the now 15 plus point sell off in the ES over night. And again, frankly, Im not smart enough to follow what the logistics of the Cyprus event are anyhow…I just watch price.

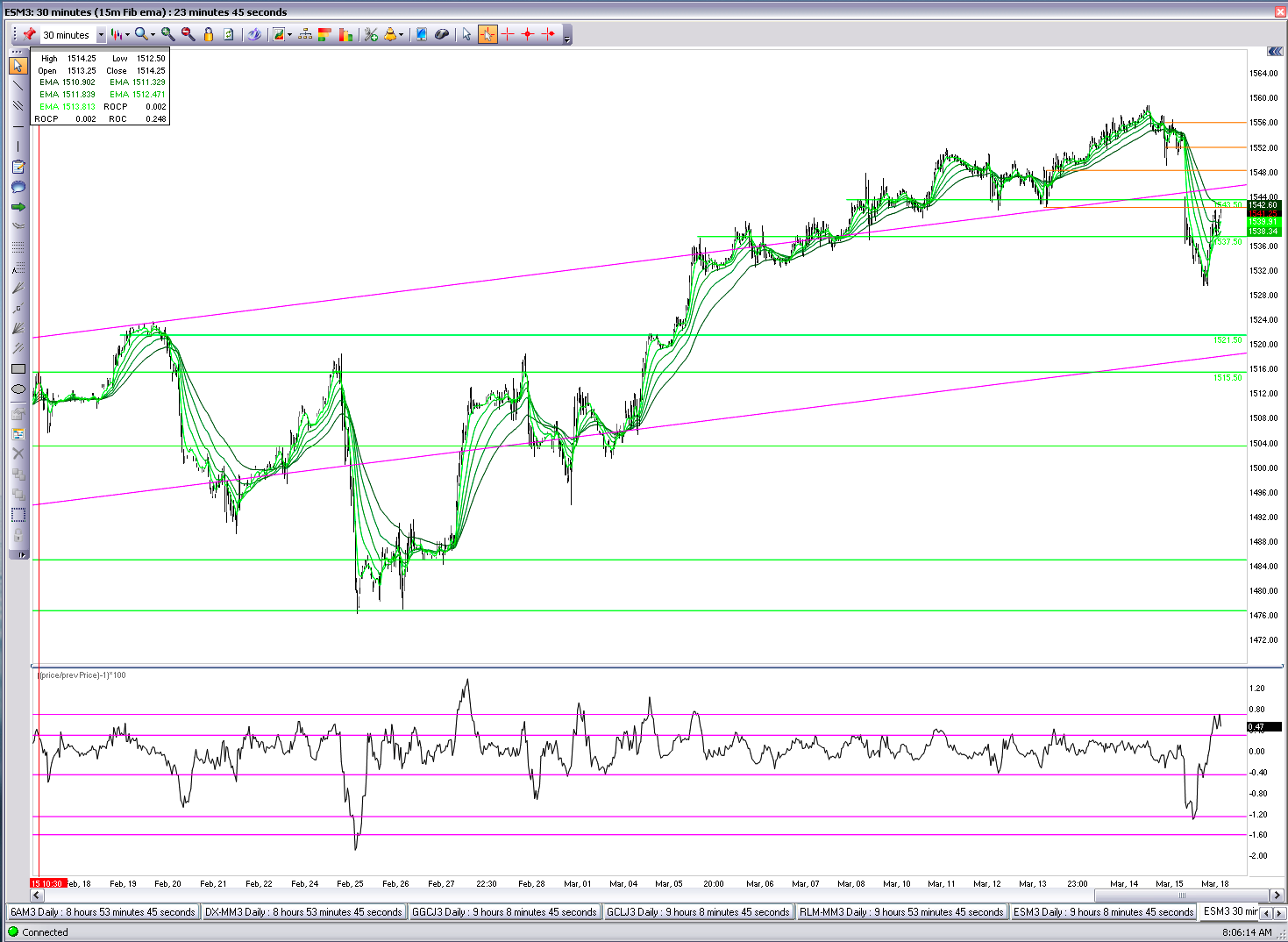

5:30 in the morning I see that futures made further lows but are rebounding. Well, at that point I do take into consideration that the dip may extend but for technical reasons. We are now below prior support- only on a daily basis however.

I go to the gym for an hour and come back to find the futures are stable below Wed OR low. A mark on the chart that I was aware of and mentioned on Friday prior. At this point there is very little premarket selling to what I hold as we sit below this level.

I start to make comparisons to other “event” lows. I don’t have to look far to find Feb 25, 26 lows as an ON low that exuded – in technical terms- the same characteristics of the sentiment shifts seen now. Although I am confident in my positions, I do make a mental note that today will not be a day to hold on to longs that close below the prior weekly range.

To this point it has been a fairly numb experience into the open with futures rising to stable. Yet it is at this same moment when the reality of the situation starts to creep and I find myself controlling the first wave of strong emotions.

Ive found that it is natural to feel these emotions but it is only price that should solidify things. I like to let some emotion sit with me as I watch price, I don’t want to ignore them because once price has had time to show me something that I can act on, that emotion will become conviction. Very important difference between conviction and feelings and seeing price confluence with conviction- there is nothing better.

So I write these feelings in Notepad, and sometimes like today, they encompass a wide range of ego boosting heckles of noise which I keep to myself- till now.

With the open not far behind I think of the move in stocks and note to myself, “I’d rather take a loss than play I told you so games off crisis b.s. happenstance events”, “Its not right or wrong to consider adding to the empty glass of acceptance beside you”, “I hope a 14pt gap somehow gets you even. You are looking to get even, right shorts?”.

Further, I have thoughts about who or why someone would be short the market into this event, just who is benefiting from this selloff. Or why someone would continue to be long of gold after this event, as its most memorable move of late is relative to this news alone. Comments- “Inside information also something that can drop on your foot and hurt”, “Why would you buy gold at third bounce off support when you could buy USD at first support after breakout”, “Channel support here but I will sell 1650 with my grandmothers jewelry if we get there #gold”.

There are some very strong emotions here, that make me laugh. I like to think the adamance reflected in these circumstance is a healthy mix of sarcasm, humor and confidence but I don’t like to get carried away like this (noted) and thats why I won’t share this on a regular basis. Sometimes I wont even write these thoughts down at all, I just let them pass. Other times writing them down helps them pass. So far midday things appear to be stabilizing, but you wont find me cheering. I like to let the market speak for itself and it may choose to do so at any time.