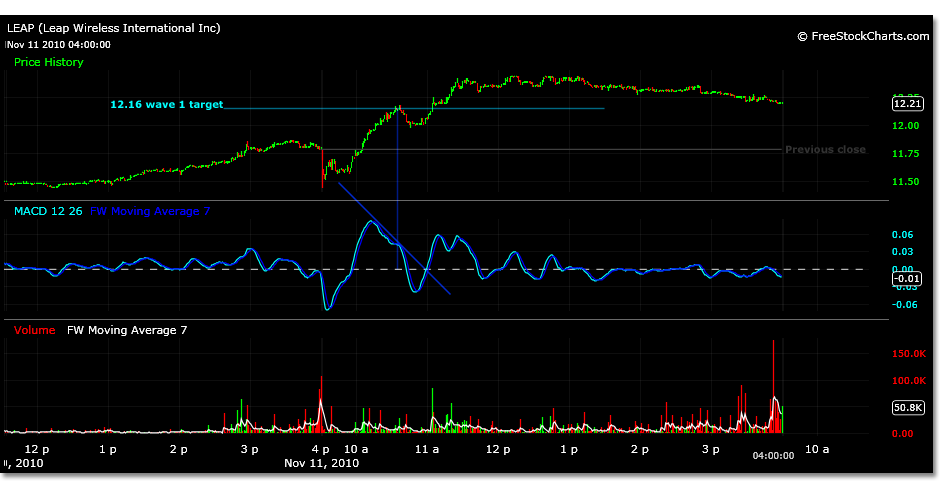

Yesterday LEAP was on the watch list for a long term wave 4 triangle to be breaking out. The chart analysis gave the possible setup and entry points. So far today, its unclear where the E wave may have ended although todays trading low of 11.34 is only a penny off the projected wave E incidentally. The other possibility is that an accelerated triangle formation could have been in play, this was mapped out in light blue.

In either case, as LEAP traded past the B wave high towards 12.16, it was apparent that the possible uptrend was developing. When LEAP traded to 12.18, two cents off the projected price, and started reversing it was following projections precisely. The correction was quite shallow however, which leaves room to re-evaluate exactly where the current wave began in actual traded prices, but shouldn’t change the projections much at this point.

Trading could have been accelerated after breaking the B wave high because it signaled a break out and traders wanted to get in. Furthermore, triangles will almost always break out with volatility. The patterns that triangles exemplify are those of indecision. So, when the time comes for price to pick its future path, the volatility of the move is expected. Many traders are scrambling to catch the move or swap out of negative positions.

With the lack of volatility in the afternoon, it is hard to say that LEAP will not provide a more precise correction in trading sessions to come. If so, this could be used to better evaluate an entry point, rather than chase the possible trade. If demand for the expected move is strong, these opportunities may remain limited.