Last night a potentially great trade for GOL was signaled by ZorTrades on StockTwits. This is a Brazilian airline play with upside.

There was an Elliott Wave off the 3/10/11 low that looked like it was reacting well to the price motion. Here is a quick rundown of how the trade is set up for me.

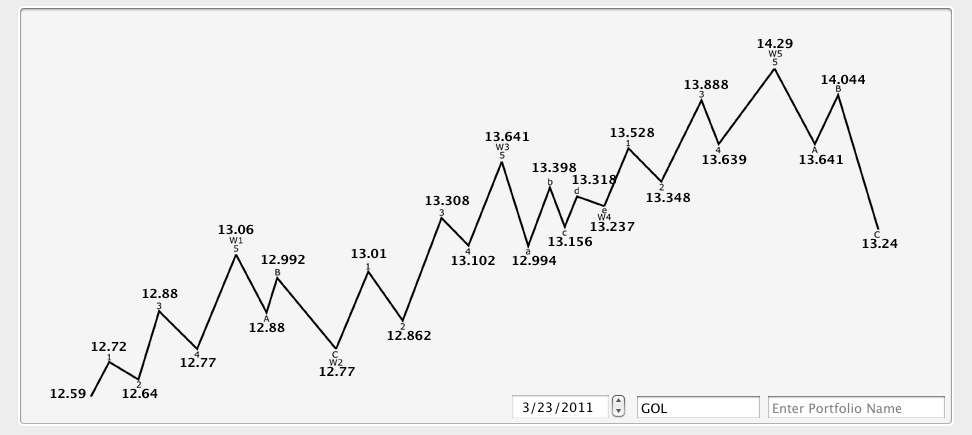

GOL trades off the 12.59 low to a high of 13.06. This is the parent wave 1 that will project future price targets. Parent wave 2 holds the price zero low.

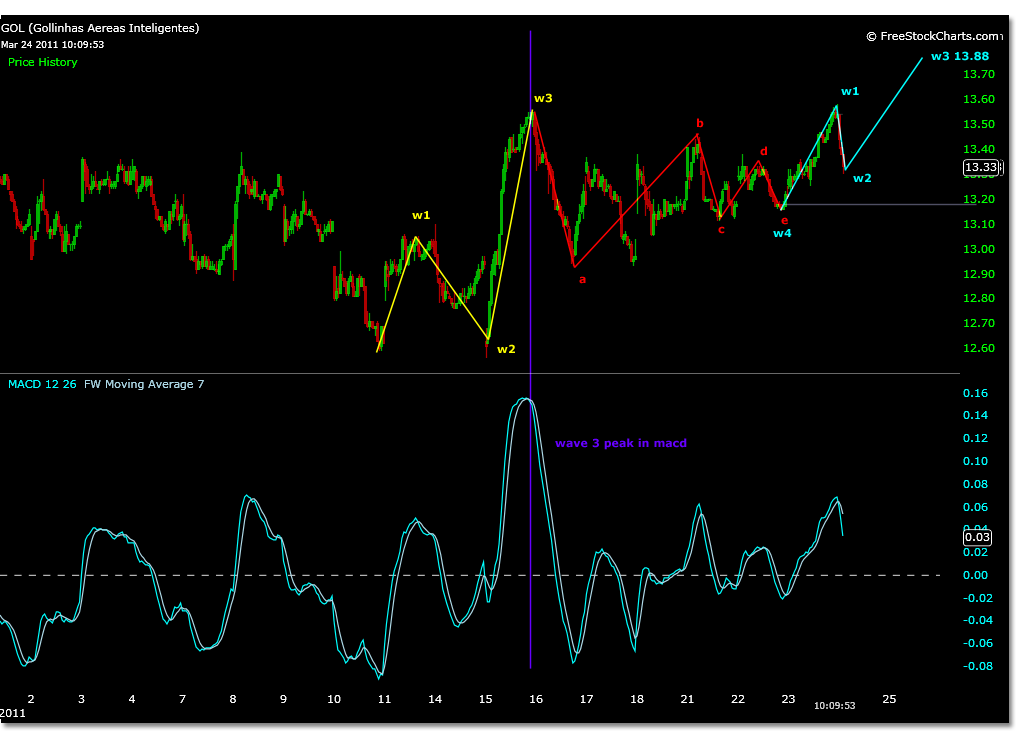

Parent wave 3 projects to 13.64, GOL trades to 13.55 and creates a large wave 3 peak in the mad shown at the 15 min time frame confirming this particular time frames count to be accurate.

GOL corrects in a triangle pattern which culminates at the E wave of wave 4 where it breaks above prior highs at wave B.

Wave 1 of wave 5 is projected to be 13.52, GOL trades to 13.58 at yesterdays close. This is where the price motion sat last night.

Watching GOL today, it has so far corrected to 13.30, where shares were purchased at 13.31 after reaching a estimated correction of wave 1 of 5 at 13.34.

The trade is set up for profits at internal wave 3 of 5 and parent wave 5, at 14.29 which would fill the gap from 2/18/11.

I put a sell stop just below the C wave of the triangle, but this wave count could still work with a correction maintaining the A wave low. Time will tell.

Also, watch the 5 dma if it crosses the 20dma at the daily time frame. This has signaled upward momentum in the past at 9/2/10.