Elliott Waves are visually everywhere and yet only exist when mathematically confirmed with the MACD structure.

Without confirmation, Elliott waves can be relative to small moments of price history and not be relative to larger moves or the trend- not relative to an all inclusive picture of the price motion in this regard.

Some Rules on Elliott Waves:

All wave 1 structures are dependent on wave 2 being maintained. The magnitude of wave 1 is the mathematical key that keeps all internal and parent waves structure intact.

Wave 3 is the strongest of waves and most volatile.

Wave 4 is the most complex of the waves and often the most time consuming.

Wave 5 carries less momentum than wave 3.

The SPX:

I do not follow the SPX relative to an Elliott Wave or have any position in the SPX currently.

I was only compelled to look at the SPX in this manner after hertcapital asked a question about an Elliott Wave pattern off the StockTwits feed.

If there is anything going on in the SPX right now relative to an Elliott Wave sequence off the recent low, 6/16/11, this would be my take…

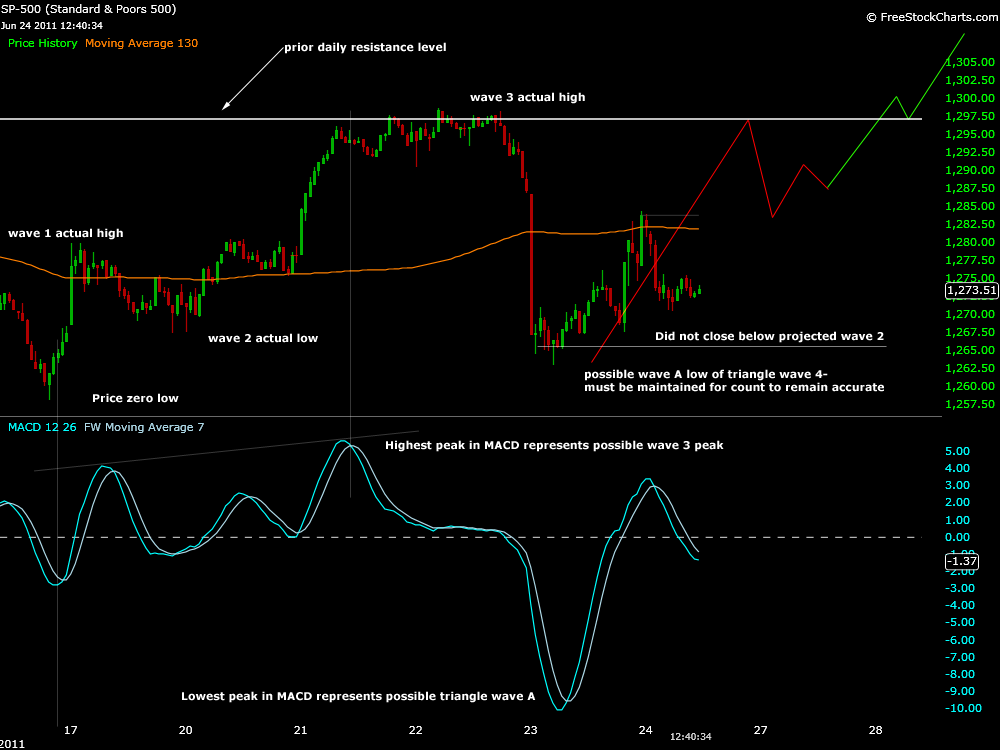

The MACD reading for the recent pullback resembles more of an A wave triangle wave 4 than a wave 2, and using the actual price points match price motion fairly accurately for a wave 3 projection.

Wave 2 is entirely possible but the beginning of that count can not be easily viewed.

The chart below shows the SPX at the 15min. time frame with notes on the possible count.

This SPX correction was a bit more extended than projections but was relatively close to maintaining the projected price corrections of parent wave 2 looking at the price projections chart.

The chart below shows the price projections using actual price points of the price zero low on 6/16/11 and possible wave 1 high on 6/17/11.

1266.3 was the projected low that needed to be maintained. Price actually never closed below this price although reached lower.

The closest closing price was actually very accurate in maintaining this wave count so far at 1266.32 according to stockcharts.com. Actual extreme lows of the correction were 1262.87.

This structure, and this low, will need to be maintained if this particular count is to be relevant.

So far after reaching what could be the A wave of a triangle wave 4, SPX has corrected higher possibly now in the B wave of the triangle.

This triangle will obviously continue to be perceived as indecision in the price of the markets but according to the wave count, a break higher is expected all things being equal in this analysis.

These projections could last the next few minutes, a day or a week before new calculations would have to be made.

Elliott waves exist until they don’t exist.

At this time I do not plan on keeping a running count of the Elliott Wave sequence in the SPX. I will monitor the pivotal wave 2 low and the wave 5 high of the given price projections.

Some More Notes on Elliott Waves:

Important to remember that every wave 5 is a wave 3 to a degree. The degree being time frame. This implies that every bullish wave is made up of 5 waves, even wave 3.

Divergence of the MACD only occurs between waves 3 and 5. However, at larger time frames this divergence will not be visible.

Hence the highest peak in MACD will represent the peak of a wave 3 of an Elliott Wave relative to time frame and wave count if a 5 wave sequence is present.

At the said time frame where the MACD peak is highest we will view this peak as a wave 3.

At smaller time frames we will see the divergence of internal waves 3 and 5 in the MACD of parent wave 3, and perhaps the completion of a wave 1 not easily viewed of an even larger time frame.

Wave 4 can correct up to the internal wave 2 low of the anticipated 5 wave sequence. This confirms the magnitude of wave 1 as relevant or irrelevant to the anticipated wave count.