HL has been on the radar since I wrote my Elliott Wave count on it in this April 2011 post.

Ive been following HL recently and although I was expecting lower prices, the recent price action combined with a re read of prior analysis had me anticipating a trade off the recent lows.

What initially swayed my interest in pursuing this analysis was a comment towards the end of the prior analysis regarding a monthly time frame projection.

The monthly comments:

“The price of 11.56 on 1/3/11 correlates very closely to the internal wave 1 of 3 projected from the low of .50 cents in year 2000.”

“That said, we are presently not sure if the internal wave 2 of parent wave 3 is completed at the monthly time frame, referenced in this monthly projection chart at estimated price of 7.16.”

That price motion projections chart seems to have foreshadowed exactly where we were headed in the wave 2 correction. HL’s recent low was 6.87.

This low will serve as point of reference for the trade setup. Similar to the prior setup for HL in this post.

While anticipating the prior low of 7.81 3/15/11 as the completed monthly correction did not pan out for the very long term trader, HL did produce fairly accurately a wave 3 target. The equivalent of what would turn out to be an ABC corrective wave higher.

Now that we have reached this new low within the same scenario, with confluence to a large time frames targets, constructive trading in HL recently could eventually confirm the larger move expected.

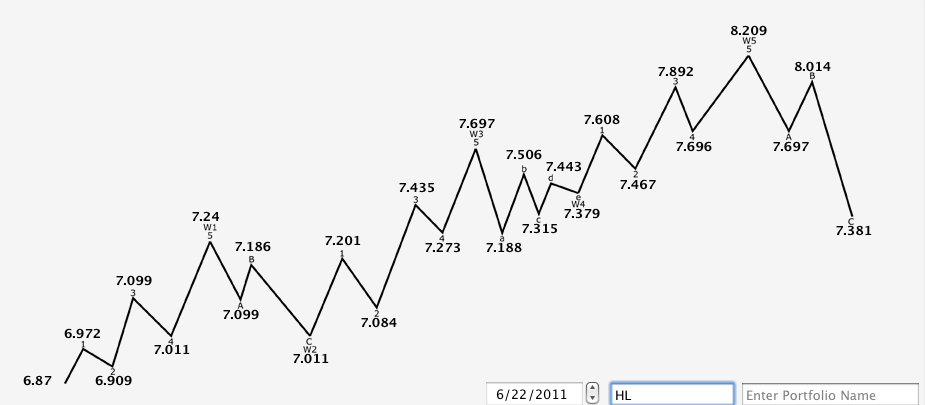

The trading in HL off the 6.87 low has so far followed an Elliott wave pattern.

The price projections show that HL has just completed a wave 3 off the low. As I am drawing up this analysis 6/22/11 and the market sells off.

This projection creates a band of buying targets between 7.38 and 7.18, per fibonacci retracement levels.

HL is passing through 7.38 right now and I am going to pick up a small starter position into the close. There is quite a big bid into the close of over 500K shares with a single lot at close to 400k. This lot did not fill but is supporting the selloff I believe towards the lower targets.

My order was filled at 7.40. So far the low of the day into the close was 7.39.

The above rundown basically solidifies what is expected from the Elliott Wave analysis. We have a target range of 7.38 to 7.18, have hit our first target and likely will reach lower given the mood of the market selloff.

A hold of 7.38 would represent a flat wave 4 correction. A move to lower levels would indicate a triangle correction forming if the Elliott Wave count remains intact.

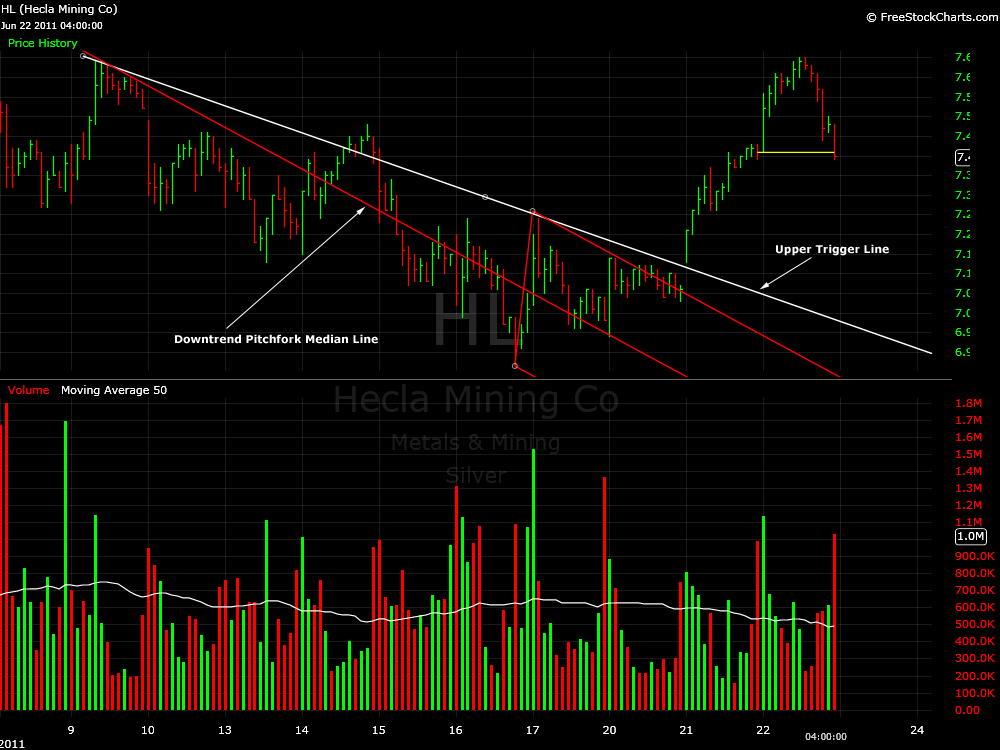

The next part of the trade setup will be analyzed using Andrews Pitchfork, something I have just begun reading about over the past month with varied success in actual trades, however, have found it very useful for pinpointing intermediate time frame trading ranges, buy and sell triggers.

The Andrews Pitchfork has very precisely targeted this weeks ramp in prices, specifically the buy trigger point, but now also the selloff.

The chart below is a 30min time frame chart of HL and shows how the red sell channel pitchfork trigger line was broken on a gap, signaling a strong buy.

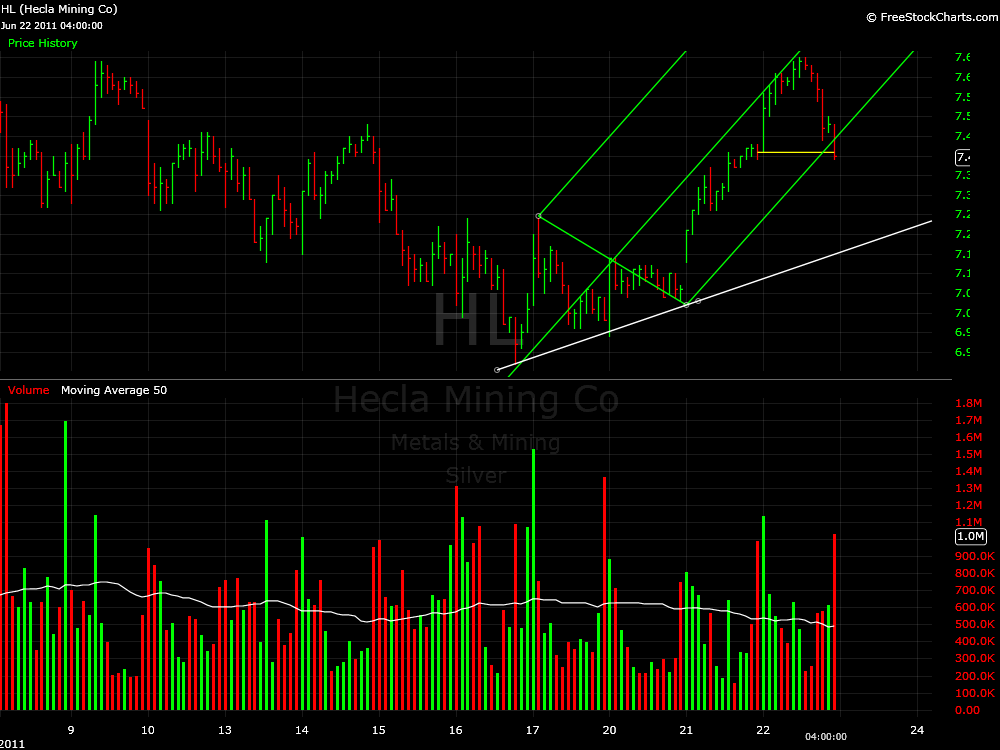

If we draw an ABC pitchfork pattern (green) from the prior low-high-low to project the beginning of a new uptrend from this buy signal, we see that HL held tight to the median line for two days and 7% run higher.

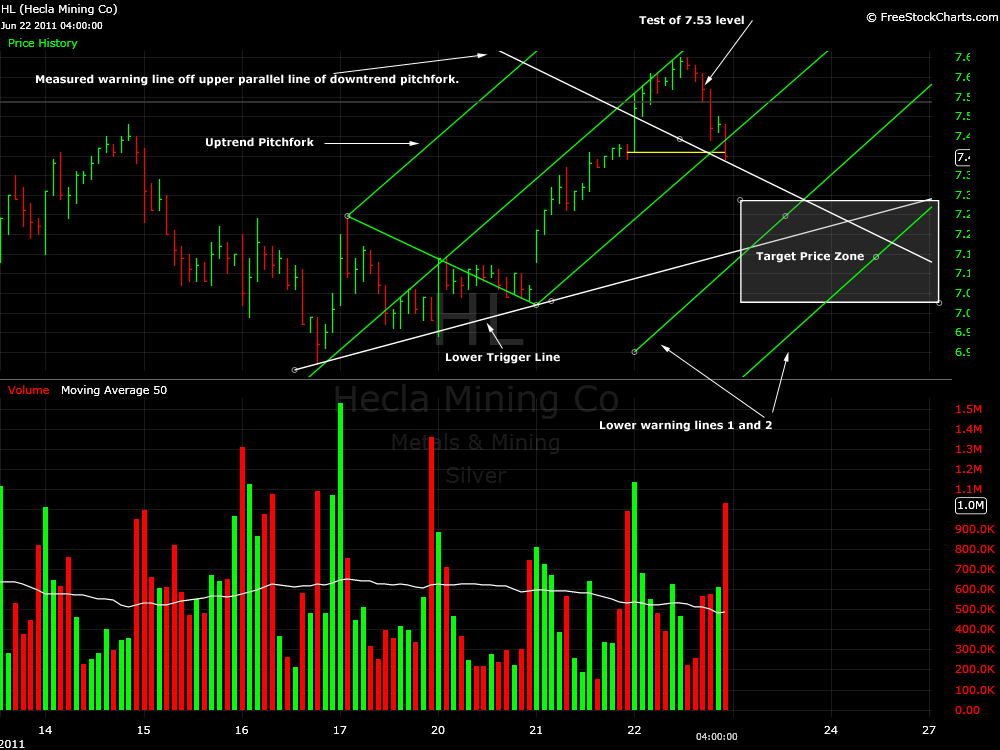

Intraday we can see that HL lost its lower parallel line on the 30min chart shown above. However, there was a precursor to this sell signal noted and is shown in the chart below. Note the way that price reacted to prior support, now resistance at the 7.53 level today.

The gray line in the chart below shows how the initial test of this level at 7.54 was successful but upon retest at the 5min time frame we can see that selling accelerated.

The chart below also shows the range of prices that I expect HL to trade for the best entry points in the shaded area.

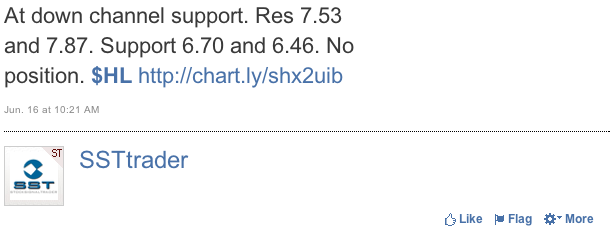

This 7.54 level was outlined in a prior Stocktwits post with chart to the HL stream earlier last week.

Of course there is a battle of trading plans here, which is not good. The Elliott Wave scenario allows for a low of 6.94 to be hit and the trend remain intact.

The Andrews Pitchfork method low trigger line sell target is .15 – .20 cents higher.

My trading plan is to buy into the weakness that the break of the trigger line will create, towards the Elliott Wave structured support, as well as the gap fill.

—————-

The above trading analysis and executions where made on June 22, 2011 and as I continued to write up the analysis into the evening I thought it would be nice to keep a running note of the price action and my trading plan as the trade developed.

I was expecting lower prices and although anticipating the trade did prepare me for the price action, I would have to deal with much more.

The following is a brief glimpse into my trading day 6/23/11.

Awake, 3.5 hrs to open, usual routine, systems up, looks to be slightly lower open. Nice, might hit my buy target. Go for walk, breakfast and at the screens again.

100 sh at 7.21 crosses in the premarket for HL. I think about it a few seconds, go to enter an order for another small tier of the position and a few thousand shares buy it out and the ask is back up to 7.34.

O.k. I can wait. Things are developing.

8:55aam disconnected from the internet. I have no clue why. My laptop says I have internet connection but nothing is streaming, everything is dead.

I trouble shoot this for 15 minutes, nothing. Fairly aggravated, knowing that I don’t have internet and HL is entering my sweet spot, I pack up my laptop and head to the library nearby which opens at 9:00.

Its 9:30am now, I’m at the library, my laptop is still not connecting to the internet and I’m sitting at a library computer with Google Finance open, the HL chart reads 7.11.

My mood is being tested greatly. I’m sitting next to seniors getting their usual fill of sterile information and quietness, and I’m breathing curses-mentally at least.

I disregard how ironic it is that this is happening to me. Sticking to my trading plan I risk logging onto my brokerage account on the public computer to check my charts. Streaming charts will not load, nor will stockcharts.com streaming charts due to the fact you cant load java or silverlight applications on the public computer- I guess.

I check the bid, the ask, lot size looks healthily on the bid. Market doesn’t appear to be free fall and I wanted these lower prices.

I enter an order at 7.08 for another small tier to my position. Set the stop loss for the full size and go back to trouble shooting my computer.

I notice that HL drops lower to 7.05 as I refresh my browser for updates, I do nothing given the situation.

I monitor the stock and trouble shoot my computer. Finally I get a connection on my laptop. I load stockcharts.com, get my first view of live price action combined with my chart markups. I feel confident that I can pack up and head home to resume my day.

10:45am now, a few more system glitches but I was back up and running. I liked what I saw in HL, my charts and the market wasn’t bothering me. I entered another order for a larger tier more than doubling my size.

I’m long now at an average price of 7.20 and ready for some lunch.

This trade may or may not work out- same as any other. But what I’ve re-learned in the past 24hrs is that nothing, aside from pure flash crash mayhem, should sway you from your trading plan and that having that plan in place is essential to execution.

Buying is sometimes harder than selling in more ways than we can often expect.

Below is a fairly confusing chart of the Pitchfork analysis I have marked up at the 30min time frame to present moment I am writing this.

We can see that the shaded area was reached nicely and the blue trigger lines from the current green uptrend pitchfork were breached momentarily in the first half hour, but so far held reasonably.

Support was found at a warning line (white) drawn off the prior downtrend pitchfork. Price motion in HL is currently following an uptrend warning line drawn off the green pitchfork. Trading in HL has now held above the 5dma for almost an hour.

What also now appears to have formed is a triangle wave 4. The chart below shows the Elliott Wave count that is still intact with price above wave 2 lows.

The MACD is extended at what should be a triangle wave 4 A wave low. The sharpest extension lower in MACD, when expecting a triangle, should represent the lowest low in price to the triangle. Divergence to this low will be seen only at smaller time frames when viewing the MACD.

All posts on HL or any ticker written about can be generated by using the meta tag links at the top of each post. HL.

Pingback: StockSignalTrader: Elliott Wave and MACD Technical Analysis For Traders » Possible Swing Point For GDXJ()