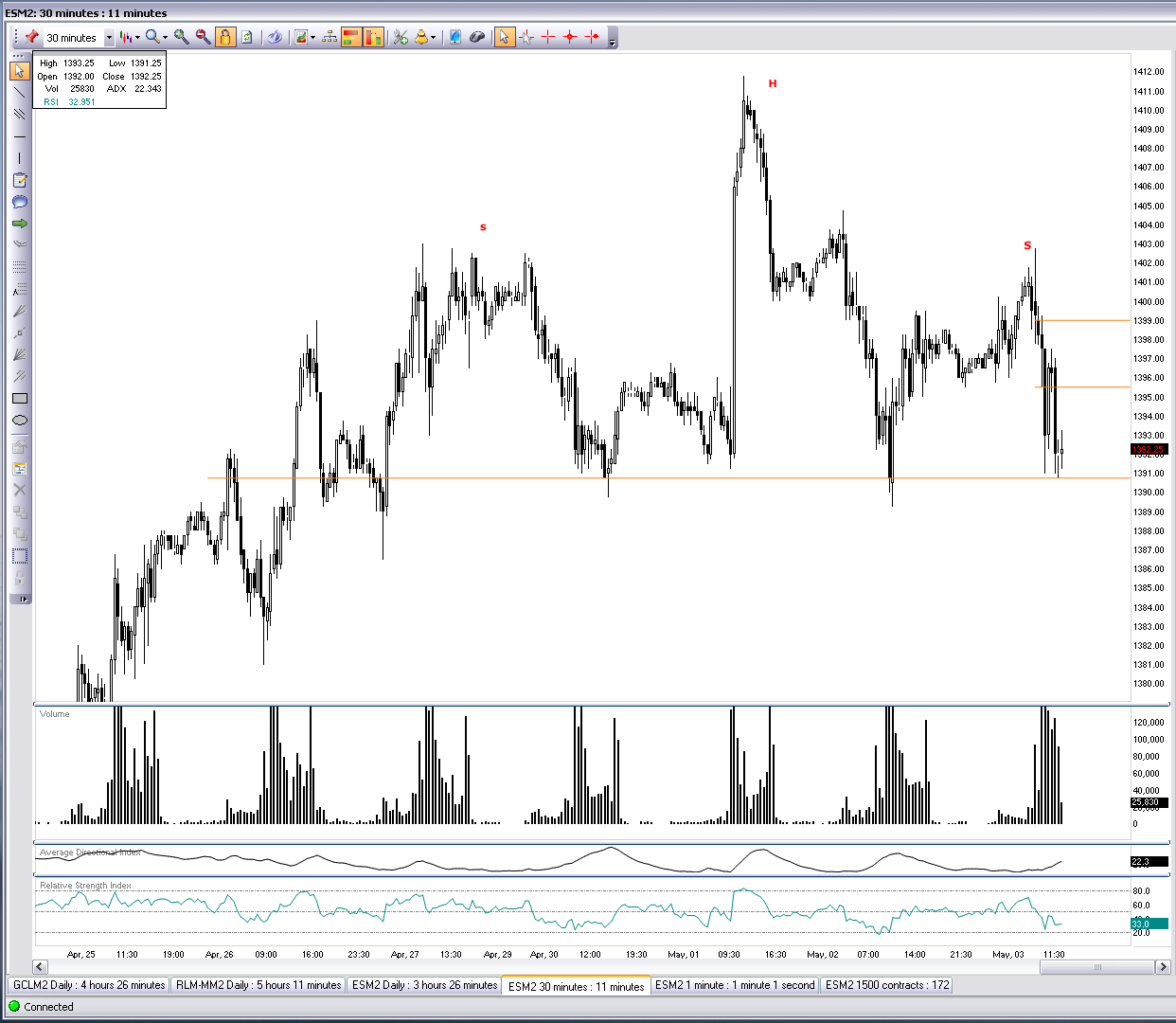

I had a slight bias long this morning after the open bounced off the overnight lows. The opening range was lost in a big way however and took my buy at 94.5 past its stop no questions asked.

After this I decided to short a rally back into the OR. The OR is shown with orange trend lines in the image below. I sold the 50% Fib at 96.75. Resistance was then found again at the OR low. There was a nice trend line break on the 1 min that held after the close below the OR level as well.

88.25 will likely act as first support if things continue lower. This Fib extention correlates roughly to S1 at 1389.58.

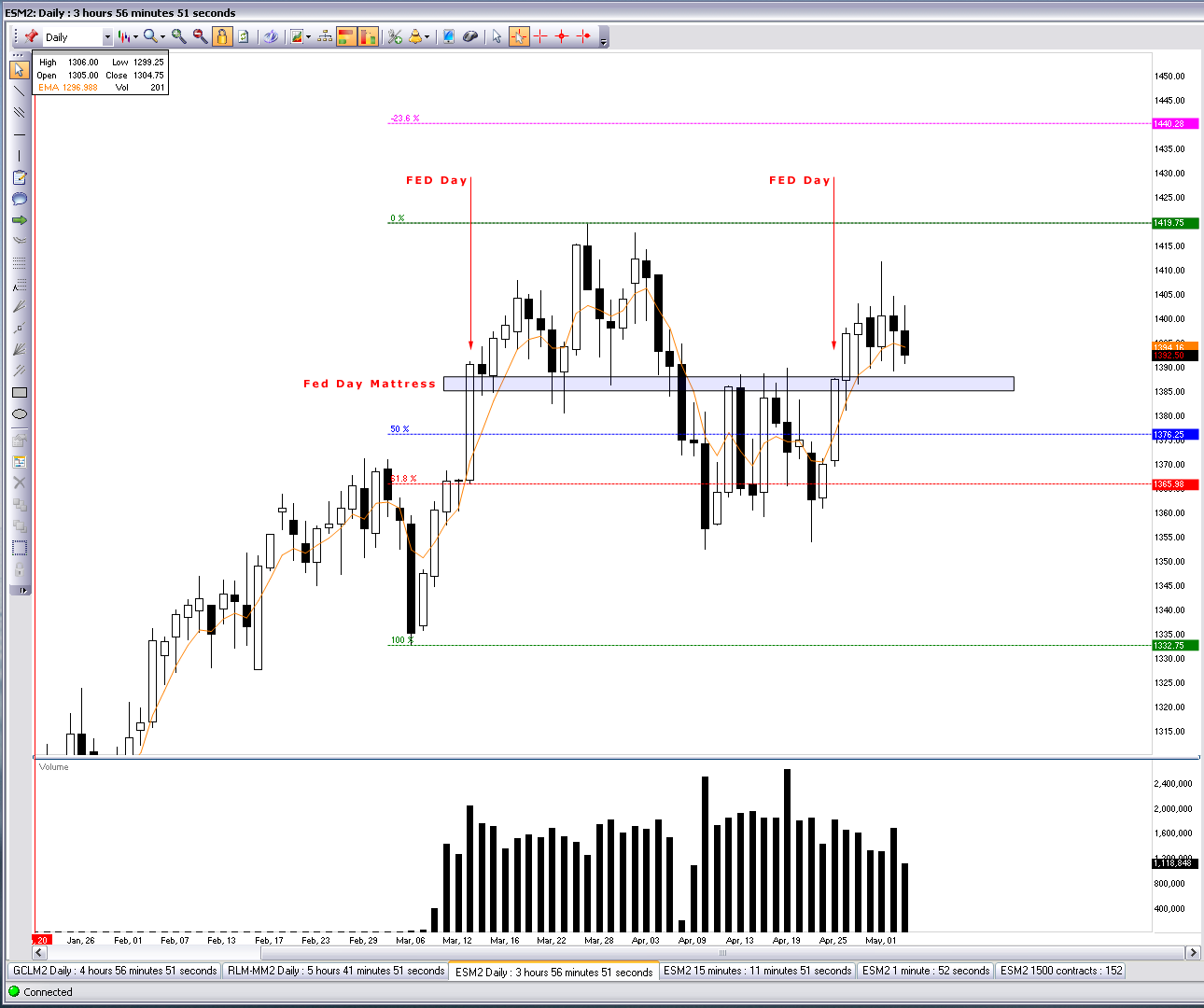

If potential for downside continues Im looking for 83.75. There is good Fib extention confluence there and this is also the Fed Day mattress zone on the daily.

Further, many are talking about the H/S patterns forming. Time to be cautious. Perhaps buyers have more to prove today then the sellers for a change.

Otherwise, I like the IYT DJT strength, but I tend to put a contrarian spin on things… I think regardless of what other indices do this sector may continue to show strength to soften fears if broader market sell off comes. This will throw people/Dow theorists for a loop, buying into weakness and perhaps a trap. Timing this day dream would be key however as 1440 is still a reachable near term upside target.